IMF Executive Board Concludes 2023 Article IV Consultation with Nepal and Completes First and Second Reviews under the Extended Credit Facility

May 1, 2023

- Completion of the first and second reviews under the Extended Credit Facility (ECF) provides Nepal with access to SDR 39.20 million (about US$52.8 million).

- Following a strong post pandemic recovery, external shocks and necessary policy adjustment led to a softening of GDP growth. The much needed monetary policy tightening helped stabilize the external position and lower inflation, while the recent mid year budget review is expected to address near term fiscal risks.

- Sustainable medium term growth will require preserving macroeconomic stability and fiscal reforms in line with debt sustainability, advancing reforms on banking regulations and supervision, reducing the cost of doing business and barriers to FDI, and enhancing governance and the social safety net.

Washington, DC: The Executive Board of the International Monetary Fund (IMF) completed the first and second reviews under the Extended Credit Facility (ECF) for Nepal, allowing the authorities to withdraw the equivalent to SDR 39.20 million (about US$52.8 million). This brings total disbursements under the ECF for budget support thus far to SDR 117.70 million (about US$157.4 million). The Executive Board also concluded the 2023 Article IV consultation with Nepal. [1]

The ECF arrangement for Nepal was approved by the Executive Board on January 12, 2022 (see Press Release No. 22/6) in an amount equivalent to SDR 282.42 million (180 percent of quota or about US$384.8 million). The ECF arrangement has helped mitigate the impact of the pandemic and global shocks on economic activity and aims at protecting vulnerable groups, preserving macroeconomic and financial stability, and supporting sustained growth and poverty reduction. The program is also helping to catalyze additional financing from Nepal’s development partners.

Despite a challenging global and domestic environment last year, including the impact of Russia’s war in Ukraine, Nepal continued to make progress with the implementation of the ECF‑supported program. The Nepali authorities have taken decisive actions to maintain a stable macroeconomic environment in the context of the post‑COVID‑19 recovery and global shocks. The much‑needed monetary policy tightening last year, together with the gradual unwinding of COVID support measures, helped moderate credit growth and lower inflation. In addition, to preserve fiscal discipline and debt sustainability, the government has rationalized spending in its mid‑year budget review in response to weaker‑than‑expected tax collections in the first half of the year. Bank asset quality has deteriorated as higher lending rates depress borrowers’ repayment capacity, though bank capital adequacy ratios are above the regulatory minima.

Real GDP growth is forecast to soften to 4.4 percent in FY2022/23, but continues to be supported by the ongoing recovery of tourism, strong agriculture sector performance and resilient remittances. Inflation remains elevated, but is projected to decline to the Nepal Rastra Bank’s 7 percent target by the end of FY2022/23. The overall fiscal deficit is expected to reach 4.5 percent of GDP in FY2022/23. Revenue collection has been disappointing, owing largely to lower import‑related taxes, but substantial expenditure rationalization announced in the midyear budget review is expected to help contain the deficit. The current account deficit is expected to narrow to 5.2 percent of GDP in FY2022/23 due to weaker import demand, lower commodity prices, a recovery in tourism and buoyant remittances that reflect a post‑pandemic increase in outward migration. Risks to the outlook are on the downside. Over the medium term, the ECF‑supported program will help Nepal’s economy respond to shocks and achieve sustainable and inclusive growth, while maintaining adequate levels of international reserves and keeping public debt at a sustainable level.

Following the Executive Board’s discussion, Mr. Bo Li, Deputy Managing Director and Acting Chair, issued the following statement:

“Nepal’s reform program supported by the Extended Credit Facility (ECF) has helped to mitigate the impact of the pandemic and global shocks on economic activity, while protecting vulnerable groups, preserving macroeconomic and financial stability, and sustaining growth and poverty reduction. While reform implementation has been slower than expected, in a difficult environment, the Nepali authorities remain committed to their economic reform program.

“Fiscal policy is focused on promptly addressing near-term fiscal pressures, while supporting the most vulnerable against elevated food and energy prices. Maintaining momentum on governance reforms is critical to cement recent gains in fiscal transparency. Fiscal consolidation and further structural reforms are needed to support medium-term fiscal sustainability. Revenue mobilization, advancing fiscal federalism, addressing fiscal risks, and strengthening public investment management are important measures.

“A cautious, data-driven approach to monetary policy, supported by macroprudential tools, is appropriate to maintain external stability and address elevated inflation. The Nepal Rastra Bank is prioritizing the asset quality of banks, including through regulatory initiatives to ensure appropriate classification of loans, and is focused on advancing the financial sector reform agenda. Measures to improve the autonomy and accountability framework of the central bank and strengthen the AML/CFT framework and its effectiveness remain crucial.

“Structural reform priorities include lowering the cost of doing business, removing barriers for foreign investment, improving governance, and strengthening anti-corruption institutions. Policies to reduce vulnerability to climate change, including through better-targeted social assistance, investment in climate-resilient infrastructure and boosting agricultural productivity are important.”

Executive Board Assessment [2]

Directors agreed with the thrust of the staff appraisal. They noted the impact that global shocks have had on Nepal through higher commodity prices, and that while the outlook is favorable, inflation remains elevated, and risks are to the downside. Directors recognized that program performance was mixed, in the context of the difficult environment, and that while there was continued progress on reforms, the pace of implementation was slower than desired. They emphasized that strong program ownership and Fund capacity development are central to achieving program objectives. Directors underscored the importance of safeguarding macroeconomic stability and supporting sustainable, inclusive, and green growth.

Directors agreed that fiscal policy should focus on addressing near-term fiscal pressures through expenditure rationalization, while protecting high-quality infrastructure and social spending. They noted the need to support medium-term fiscal sustainability through fiscal consolidation and continued progress on fiscal structural reforms. Important measures include advancing revenue mobilization reforms, strengthening the fiscal federalism framework, and improving public investment management. Directors stressed that maintaining momentum on governance reforms is critical to cementing recent gains in fiscal transparency and that strengthening the financial oversight and governance of public enterprises would help to limit fiscal risks.

Directors agreed that monetary policy, supported by macroprudential measures, should take a cautious, data driven approach to maintain external stability and address elevated inflation. They noted that while capital adequacy ratios remain above regulatory minima, non-performing loans are increasing. Directors thus concurred that the central bank should prioritize bank asset quality. They recommended advancing the financial sector reform strategy and implementing the outstanding 2021 safeguards assessment recommendations, including to improve the autonomy and accountability of the central bank. Directors noted the importance of improving financial inclusion through digitalization. They stressed the need to strengthen efforts to enhance the AML/CFT framework and its effectiveness.

Directors highlighted the importance of an ambitious structural reform agenda and recommended reforms to reduce the cost of doing business, lower barriers to foreign investment, and enhance governance and anti-corruption. Noting Nepal’s vulnerability to climate shocks and natural disasters, which can hamper poverty reduction and exacerbate food insecurity, Directors stressed the need for better targeted social assistance, enhanced agricultural productivity, and investment in climate resilient infrastructure.

It is expected that the next Article IV Consultation with Nepal will be held in accordance with the Executive Board decision on consultation cycles for members with Fund arrangements.

[1] Under Article IV of the IMF's Articles of Agreement, the IMF holds bilateral discussions with members, usually every year. A staff team visits the country, collects economic and financial information, and discusses with officials the country's economic developments and policies. On return to headquarters, the staff prepares a report, which forms the basis for discussion by the Executive Board.

[2] At the conclusion of the discussion, the Managing Director, as Chairman of the Board, summarizes the views of Executive Directors, and this summary is transmitted to the country's authorities. An explanation of any qualifiers used in summings up can be found here: http://www.IMF.org/external/np/sec/misc/qualifiers.htm .

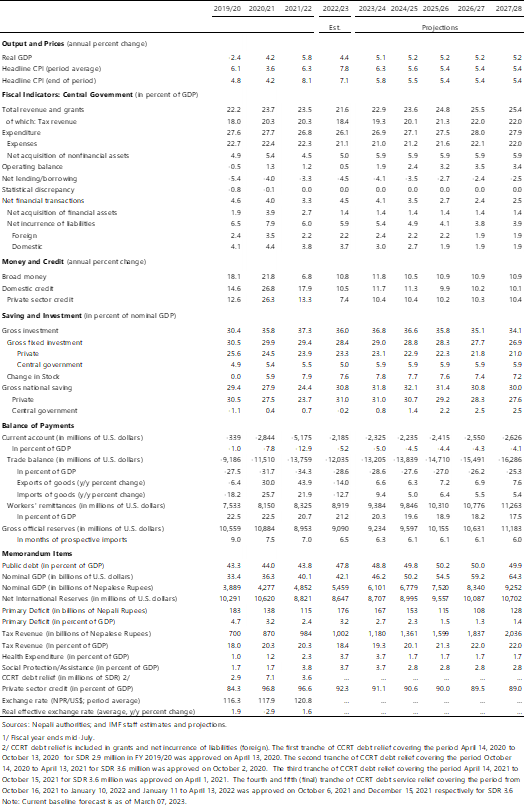

Nepal: Selected Economic Indicators 2019/20-2027/28 1/

IMF Communications Department

MEDIA RELATIONS

PRESS OFFICER: Pemba Sherpa

Phone: +1 202 623-7100Email: MEDIA@IMF.org