A medical worker tests for the COVID-19 virus in Uganda. The health pandemic hit the country hard and was partly responsible for the halving of its real GDP growth. (Photo: Nicholas Kajoba/Xinhua/Newscom)

Supporting Uganda's Recovery from the Crisis

July 12, 2021

The IMF has approved a three-year financing arrangement for Uganda under the Extended Credit Facility (ECF), which will generate more inclusive, sustainable growth. This will be achieved through better spending composition and stronger governance.

Related Links

In a conversation with IMF Country Focus, the IMF Mission Chief for Uganda Amine Mati and Resident Representative Izabela Karpowicz explain that the funding will help Uganda recover from the COVID-19 pandemic and boost income in the medium term.

Uganda, along with much of sub-Saharan Africa, has faced extraordinary challenges since the pandemic hit. Can you explain why IMF financing is necessary now?

Before the pandemic, Uganda’s economy grew, on average, by about 6 percent. However, even then, per capita income growth had started to slow because of high population growth.

The global and domestic shocks hit Uganda hard, halving its real GDP growth to only 3 percent in fiscal year 2019/20, and opening sizeable fiscal and external financing gaps.

An earlier disbursement in May 2020, alongside other donor funds, helped support the government’s efforts to mitigate the impact of the pandemic.

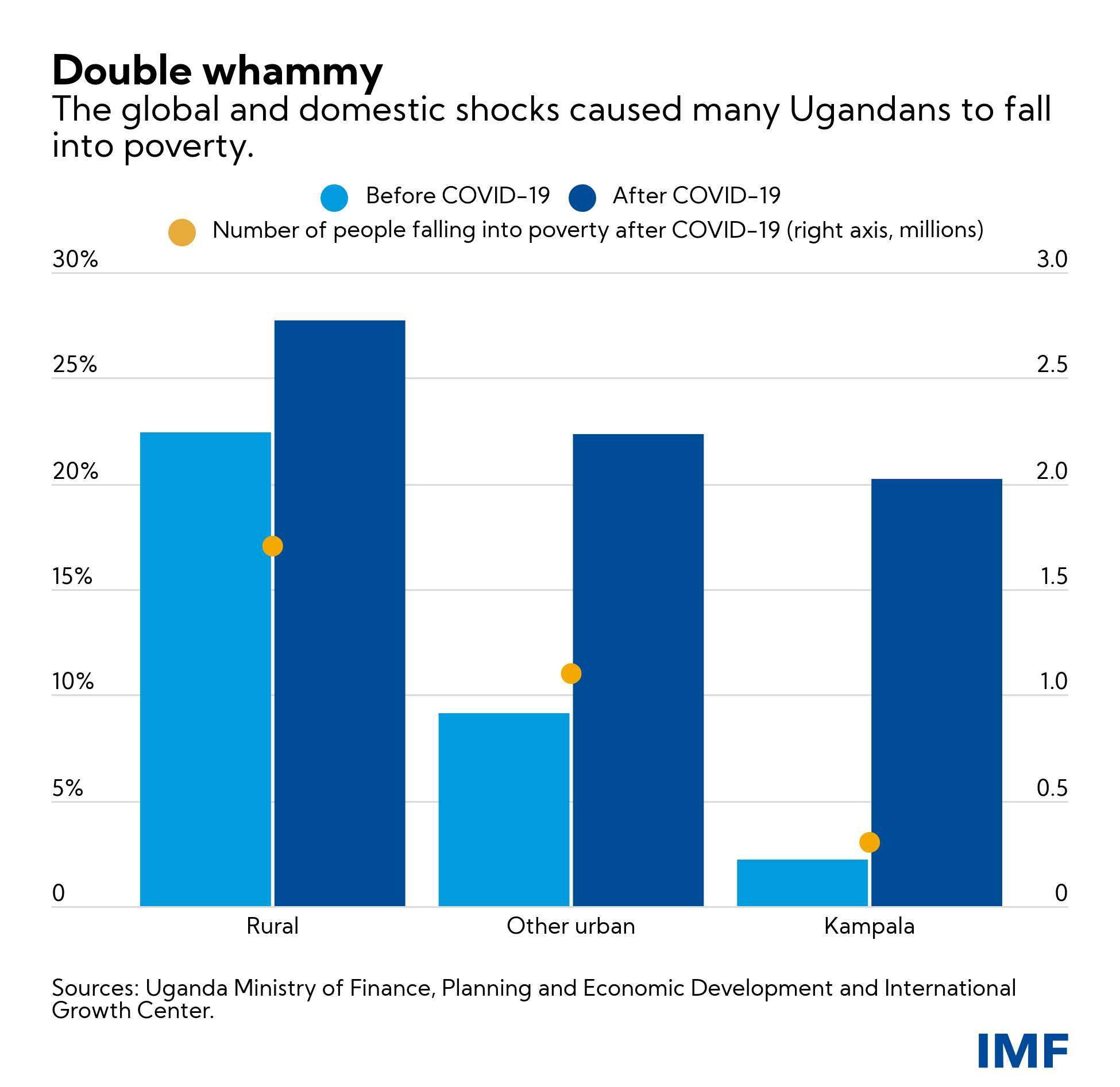

But they were not sufficient to prevent an increase in poverty, in particular in urban areas. (See chart below.) It is estimated that poverty increased by 7.5 percent nationally by early 2021.

A second wave of the pandemic triggered a new lockdown in June that is expected to exacerbate already high unemployment and financing constraints.

The new loan will provide concessional financing to counteract the effect of the crisis by supporting Uganda’s efforts to fight the COVID-19 pandemic and generate more inclusive growth through private sector development.

This requires fiscal consolidation to create space for the private sector, while improving spending composition, at the same time maintaining debt sustainability and strengthening governance.

How much will Uganda receive under the program? How will the loan be disbursed and what are the terms of the financing?

Uganda’s economic program will be financed by the Extended Credit Facility (ECF) loan for 3 years. The loan carries a zero-interest rate, with a grace period of 5½ years, and a final maturity of 10 years. The loan amount is about $1 billion, disbursed in tranches.

These disbursements are subject to half-yearly reviews, which will look at the government’s progress in implementing its economic reforms. The available funds will be used to finance the budget. Uganda received the first disbursement of around $258 million when the program was approved in June of this year.

What is the outlook and how will the IMF-supported program help Uganda strengthen its economy in the years ahead?

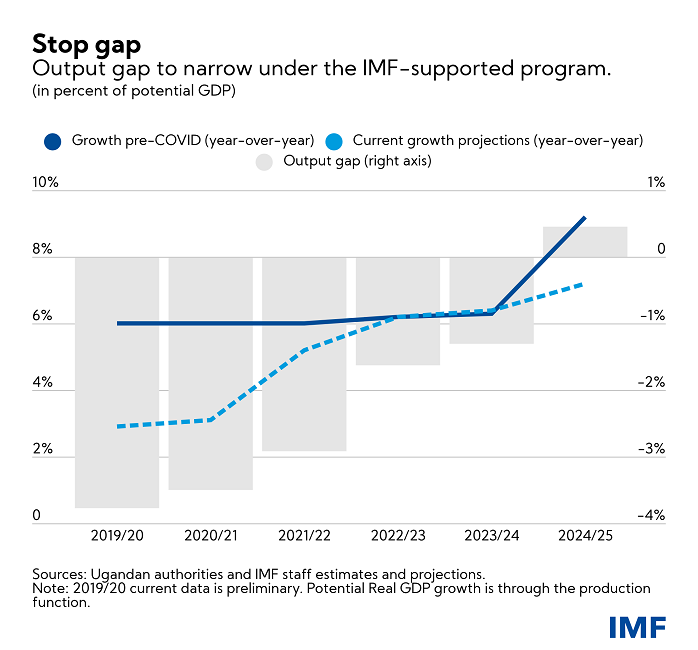

For fiscal year 2021-22, we project growth of around 4.3 percent, which will start returning to pre-pandemic levels of around 6 percent by fiscal year 2022-23.

The IMF-supported program builds upon agreed reforms detailed in the authorities’ National Development Plan . It envisages a broad-based fiscal consolidation in the first year, with the adjustment driven mostly by an increase in domestic revenues in subsequent years. (See chart below.)

The increased fiscal resources will allow higher priority social spending, including on vaccines and protecting vulnerable households, and will facilitate more efficient investment in infrastructure.

The successful consolidation effort will reduce public debt and help create space for the private sector—the main engine of growth. With subdued inflation and growth below potential, monetary policy will be accommodative while a stronger financial sector and robust governance will help support the fiscal strategy.

There is public concern in Uganda over transparency and accountability. How has the government committed to using this financing and previous IMF assistance for its intended purpose?

The authorities have committed to a number of strict governance measures to ensure that the resources are used appropriately. As part of the earlier loan received under the IMF’s Rapid Credit Facility (RCF), the authorities reported the COVID-19 spending (and cash releases for fiscal year 20/21); they published on-line summaries of large COVID-19-related procurement contracts (above USh500 million for works contracts, and above USh200 million for goods and services), together with the names of awarded companies; and published an independent audit of COVID-19 expenditures for fiscal year 2019/20.

A special audit of COVID-19 spending related to the first three quarters of fiscal year 2020/21 was finalized in June this year; it will be discussed in Parliament and updated when end-year results become available.

Going forward, the authorities have adopted a new procurement template for COVID-19 projects, which will include information on beneficial owners of awarded companies. A stronger asset declaration regime, and enhanced scrutiny of financial transactions of politically exposed persons is also planned, along with financial sector supervision that is risk-based and focused on Anti-Money Laundering and Combating the Financing of Terrorism (AML/CFT). These reforms could contribute to Uganda's exit from the Financial Action Task Force’s (FATF) “grey list” of jurisdictions with deficiencies in AML/CFT frameworks.

How will the program prioritize and re-focus government efforts on social spending while keeping debt sustainable?

The first objective is to protect livelihoods in the near term and secure sufficient funding for human capital development and job creation for a rapidly growing population. The fiscal year 2021/22 budget includes financing for COVID-19 vaccines and ring fences resources for social protection, education and health.

Social spending is monitored under the program through two indicative targets that set minimum amounts for total social spending and targeted social assistance programs.

The fiscal strategy—which budgets for higher social spending—also aims to reduce the country’s deficit—the main contributor to debt in past years. This strategy, which relies on higher domestic revenue (including from a broader revenue base) is expected to put debt on a declining path and move closer to the target of 50 percent of GDP.