Skyline of Toronto City, Ontario. Under the federal backstop system, most households in Ontario will receive more in tax rebates than they incur in costs resulting from pollution pricing. (photo: espiegle by Getty Images)

Four Charts on Canada’s Carbon Pollution Pricing System

March 18, 2021

With a federal price on carbon now written into law, Canada is fighting climate change. The country’s enhanced carbon pricing measures put it on track to meet its Paris Agreement targets, providing a model for other large-emitting countries to follow.

Related Links

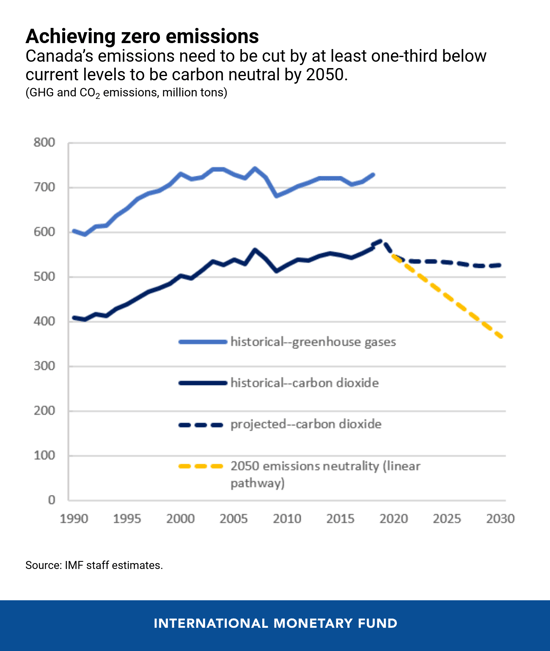

Canada has pledged to cut greenhouse gases by about 30 percent below current levels by 2030 and to achieve emissions neutrality by 2050. To meet these ambitious targets, the country is steadily ramping up its price on carbon.

The following four charts illustrate the "why and how" of Canada’s carbon pricing arrangement.

- Canada’s mitigation strategy is built around a federal carbon pricing backstop system—the Pan-Canadian Framework. Without this, Canada would be the tenth largest emitter in absolute terms in 2030. To meet its goal of being carbon neutral, emissions would need to be cut by one-third below current levels by 2030, and by two-thirds by 2040.

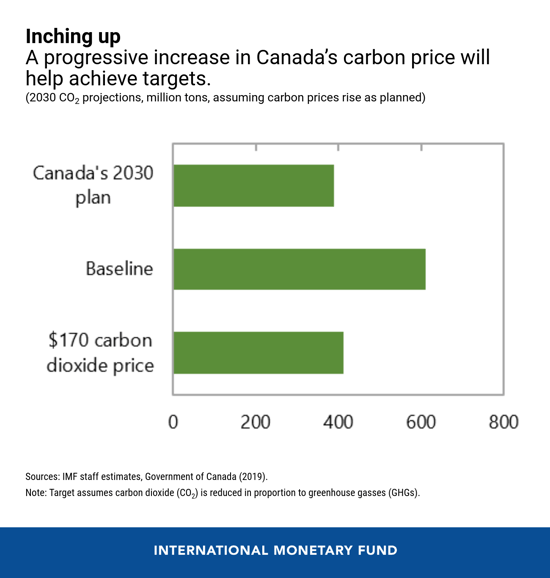

- The backstop gives provinces and territories flexibility to develop their own systems, but also establishes a carbon price “floor.” The price will progressively rise from CAN$40 per ton in 2021 to CAN$170 per ton by 2030, helping to cut nationwide carbon dioxide (CO2) emissions about 33 percent below business-as-usual levels, in line with the country’s targets.

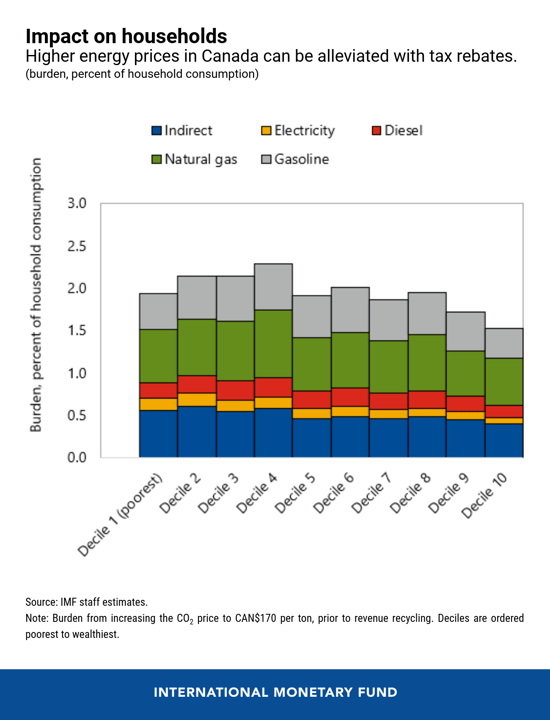

- A drawback of carbon pricing can be the burden of higher energy prices on households—particularly for lower-income families who spend a greater proportion of their income on energy. Under the current plan, the burden for the average Canadian household in 2030 will be about 2 percent of consumption. Canada addresses this issue by returning carbon pricing revenues to households in the form of a tax rebate or through investments, offsetting about 80 percent of the burden. This is especially important as Canada recovers from the COVID-19 pandemic.

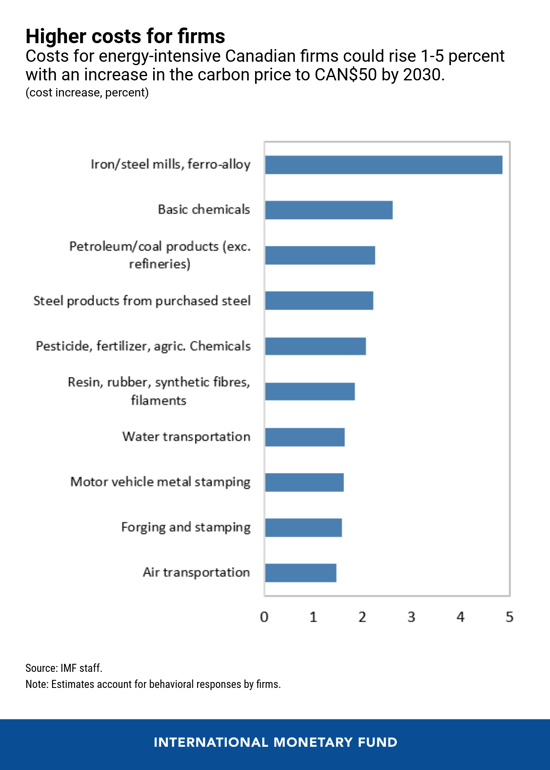

- Another concern is the impact of carbon pricing on industrial competitiveness, especially for energy-intensive firms competing in global markets like metals and chemicals. Even a CAN$50 price would raise costs 1-5 percent. In Canada these firms are required to reduce their emissions per unit of production but are not required to pay taxes on their remaining emissions.

While Canada is in the vanguard, momentum for carbon pricing is building globally. For example, carbon prices in the EU have recently risen to US$45 per ton, and more recently China and Germany have introduced pricing schemes. However, scaling up is difficult when countries act alone. Concerns about international competitiveness and whether other countries remain committed to their targets can hamper mitigation efforts.

An international carbon price floor would be more effective. Under this scheme, large emitting countries would agree to simultaneously implement a minimum price on their carbon emissions (as well as meet mitigation commitments). The price floor could be designed equitably with stricter requirements for advanced economies and assistance for lower-income economies. It could also be applied flexibly to accommodate alternative approaches and would be more effective than border carbon adjustments.

Canada’s experience, where governments have the flexibility to meet carbon pricing requirements set at a higher level, provides a valuable prototype for how this approach could be applied globally.