Pedestrians cross a busy intersection in downtown Toronto, Canada, where economic growth has moderated this year (photo: KathrynHatashitaLee/iStock)

Six Charts on Canada’s Economic Outlook for 2019

June 25, 2019

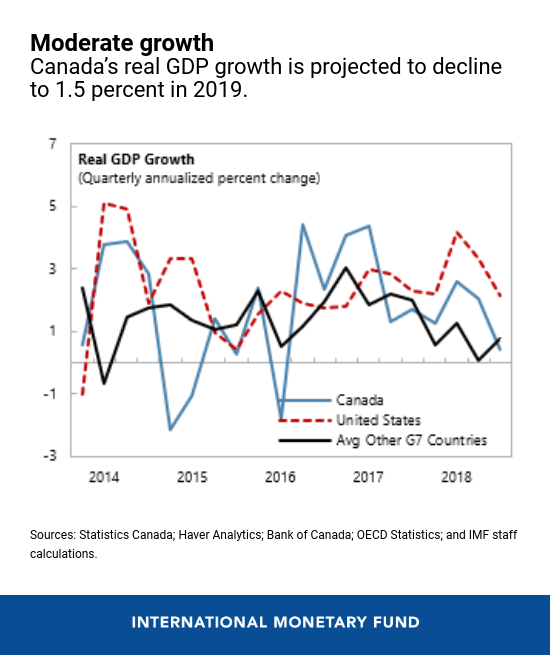

Canada’s economy is growing at a more sustainable rate following the stellar pace set in 2017—the fastest among G7 economies. Growth is projected to decline to 1.5 percent in 2019 due to a disappointing first quarter for exports, more subdued global growth, and slower pace of consumer spending.

Related Links

To sustain long-term growth, Canada will need to continue preserving financial stability, as well as focus on policies that boost productivity through export diversification, lower internal trade barriers, and higher infrastructure investment, the IMF stated in its latest annual economic assessment.

Here are six charts that tell the story:

-

Canada's growth has moderated to a more sustainable rate. A slowing global economy and low oil prices have dampened exports and business investment, while private consumption and residential investment have decelerated in line with the slowdown in the housing market, rising interest rates, and slower real income growth.

Nevertheless, demand for exports will be supported by a robust US economy with Federal Reserve policy likely to remain accommodative and the expected approval of the United States–Mexico–Canada Agreement (USMCA), which will reduce trade uncertainty. The elimination of US tariffs on steel and aluminum imports and Canada’s retaliatory measures will also generate positive benefits.

-

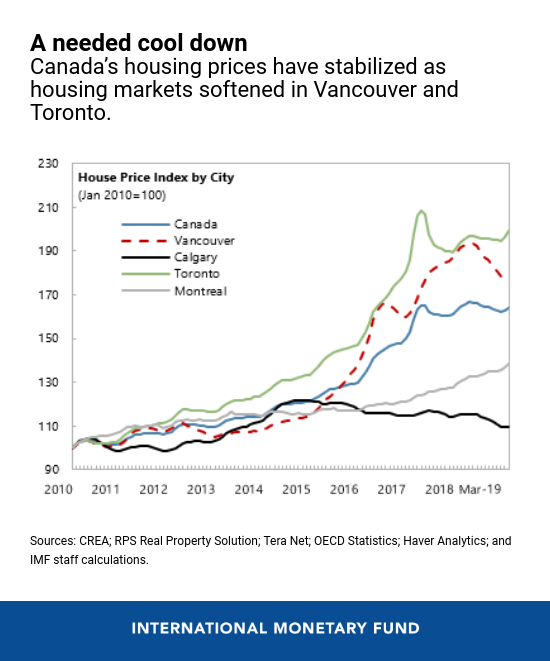

The housing market is cooling down. A combination of financial stability measures and tighter monetary policy has made mortgage financing more expensive. As a result, residential mortgage credit growth has slowed to just 3.1 percent and the number of new mortgages extended to highly indebted borrowers has fallen sharply.

Nationwide, house prices are 2.5 percent lower than the peak in mid-2018. In Toronto, Hamilton, and Vancouver, declines in house prices have reduced speculative “froth” but prices remain overvalued. Overall, policies that strengthen financial stability have been effective in containing housing-related financial stability risks and the current stance is appropriate. While the stock of household debt is still high at 176 percent of disposable income, reductions in housing market imbalances have led to somewhat lower near-term risks to growth and financial stability.

- The financial system is resilient, but households and mortgage insurers

would be vulnerable.

Canada has a robust financial system. Furthermore, according to the recent IMF Financial Stability Assessment Program report, the financial system would be able to withstand severe shocks. However, vulnerabilities—notably elevated household debt and housing market imbalances—remain substantial, posing financial stability concerns. Major deposit-taking institutions would remain resilient because they hold enough capital and liquidity buffers.

But the impact on households would be significant as the share of households with debt at risk (defined as households with mortgage payments greater than 40 percent of income) would increase from 17 percent to 29 percent. Mortgage insurers would need a capital injection. The Canada Mortgage and Housing Corporation, as well as the private mortgage insurers, would need additional capital of Can$15 billion (around 0.7 percent of GDP) to meet the supervisory target ratio.

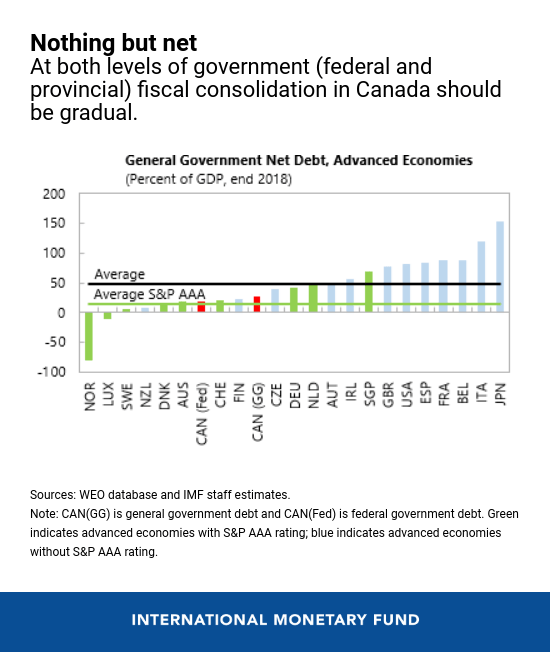

- At both the federal and provincial levels of government, fiscal

consolidation (for example, either by cutting spending or raising

taxes) should be gradual, with potential government savings targeting

deficit and debt reduction.

The planned adjustment is appropriate at the federal level but provincial governments should do more to create more spending room. This will help ensure that both levels of government have enough room to respond in case of a downturn and reducing debt faster would provide more options to handle future challenges, such as those related to aging and weak productivity growth.

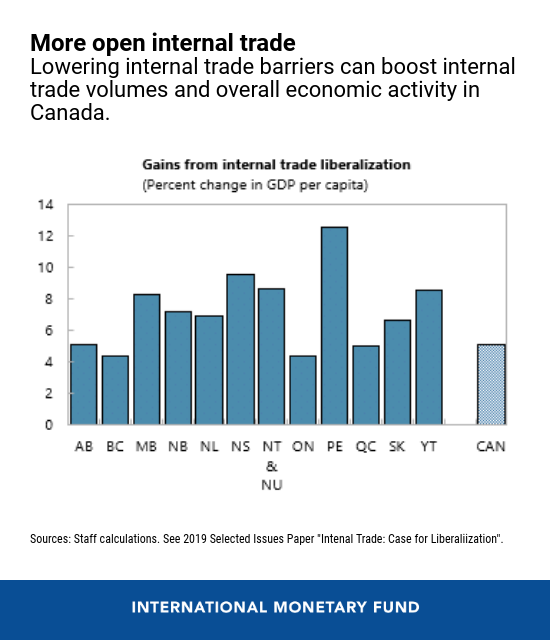

- Canada's economy can benefit from more open internal trade.

Beyond international trade, there are significant opportunities for productivity gains from promoting internal trade. But many non-tariff trade barriers exist in Canada due to the division of powers and responsibilities between federal and provincial authorities. These trade barriers hinder labor mobility, narrow consumer choice, fragment markets, stifle competition, and limit the effective scale of production.

Staff analysis suggests lowering non-tariff trade barriers could increase real GDP per capita by almost 4 percent—a much larger gain than expected from recently-signed international trade agreements. With much at stake, federal, provincial and territorial governments should make reducing internal trade barriers their common priority.

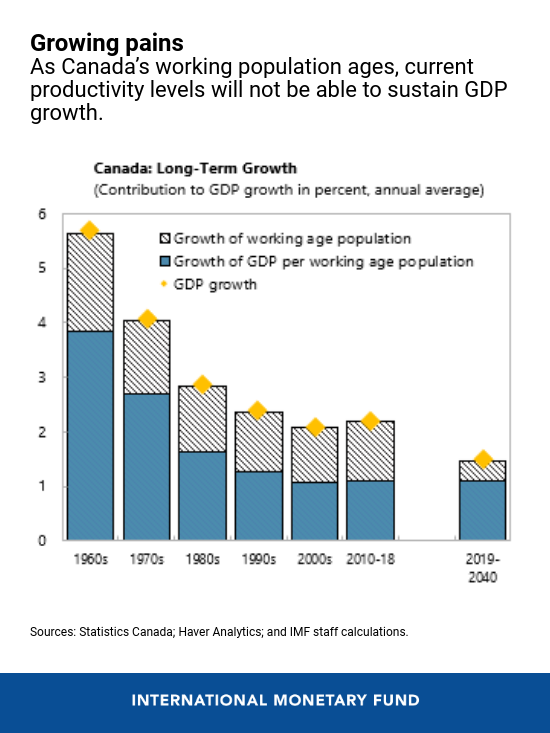

- With an aging working population, Canada needs to boost productivity to

lift long-term growth.

Structural reforms must remain a key objective of the government’s growth agenda. Implementation of the Innovation and Skills Plan is underway but addressing restrictive regulations in product markets and foreign direct investment is still pending. Efforts to encourage infrastructure investment are welcome, including progress in fully operationalizing the Canada Infrastructure Bank. However, challenges in project selection, execution and coordination—especially at the provincial and municipal levels—must be overcome to avoid delays in infrastructure investment. Canada’s long-term interest may be better served with a more detailed strategic infrastructure plan to prioritize projects, including encouraging greater inter-provincial trade.