School children in Chad: a healthy fiscal position would help the country refocus spending on investment and priority areas like health and education to improve social conditions (photo: yoh4nn/iStock)

Stability on the Horizon for Chad

September 28, 2018

Chad, a low-income country in sub-Saharan Africa, faces significant development challenges, which have recently intensified due to declining oil revenues and increased spending on security. The country has also been affected by drought and an influx of refugees from neighboring countries, adding pressure to the already fragile Chadian economy.

Related Links

IMF Country Focus recently caught up with Chad’s mission chief, Said Bakhache, to discuss how the country is dealing with these challenges and what steps are being taken to get the economy back on track.

What were some of the economic challenges facing Chad in recent years?

The sharp decline in oil prices that started in late 2014 has had a severe impact on Chad’s economy. While oil revenues decreased, its external debt service burden increased significantly, primarily to Glencore, a commodities trading firm that provided Chad oil-backed loans in 2013 and 2014 against future oil exports. This led to a severe contraction in public spending in 2015–16.

This adjustment, and the accumulation of large domestic arrears, set in motion a vicious cycle of contraction in economic activity, domestic revenue, and government spending. Consequently, income per capita, which peaked at $1,239 in 2014, fell to $810 in 2017.

These budgetary problems have been compounded by the tense security situation, particularly in the Lake Chad basin. Chadian security forces had to be deployed across the country to undertake regional peace-keeping efforts, the costs of which put pressure on the national budget.

The severe drought, and the resulting food insecurity also added to the country’s problems. The humanitarian crisis in the region has also had a spillover effect on Chad, which hosts a large number of refugees and displaced persons.

Given the considerable debt challenges, what steps is the government taking to address them and improve financial resilience more generally in Chad?

In this difficult context, further fiscal consolidation was no longer feasible. A more gradual, revenue-led, fiscal adjustment, together with financial support from the IMF—under its Extended Credit Facility [ECF]—and other donors was necessary to support reform efforts.

The restructuring of the Glencore debt—expected to be fully repaid by 2026 under current oil price projections—has helped to restore debt sustainability and generated much needed resources for the government. The new debt contract includes a significantly longer maturity, lower interest rate and fees, and contingency mechanisms to adjust debt service depending on oil revenues. This will help maintain debt sustainability under different oil revenue scenarios.

Fiscal performance has been encouraging. Non-oil revenue improved markedly in 2017 and spending discipline has been maintained. It is expected that non-oil GDP will begin to rebound this year and deflationary pressures will ease.

Progress is also underway to strengthen the banking sector, which was showing signs of vulnerabilities, with high nonperforming loans and a tight liquidity position. In addition to addressing specific vulnerabilities in domestic banks, the IMF-supported program provides room to gradually reduce domestic public debt to banks and clear domestic arrears, both of which are expected to help improve banks' liquidity and support the recovery.

But isn’t the adjustment hurting public servants? Why did the government cut benefits and allowances, despite mounting social tensions?

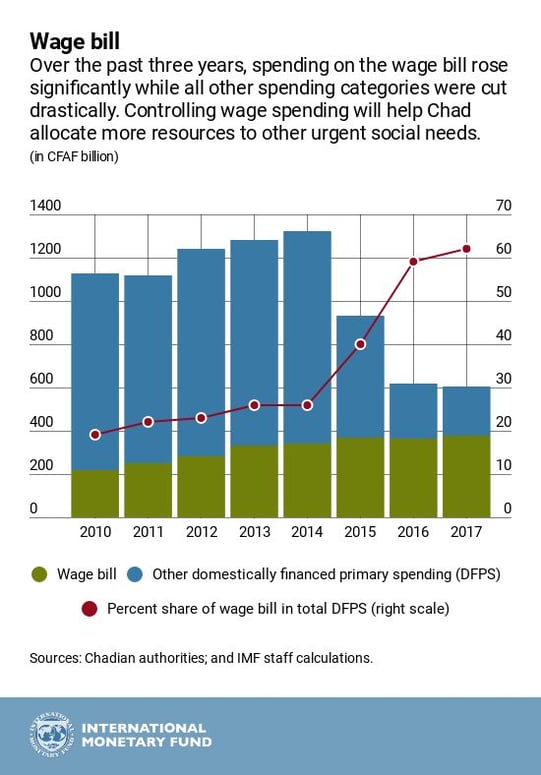

The government recognizes that the continuing rise in the wage bill, which includes large benefits and allowances, has undermined its ability to allocate resources to other key spending categories to meet the needs of all Chadians. In fact, over the past three years, spending on the wage bill has been rising when all other spending categories were cut drastically. As a result, the overall wage bill in 2017 represented more than 50 percent of domestically financed primary spending and exceeded non-oil tax revenues, significantly above the average for sub-Saharan African countries and among the highest in the CEMAC [the Central African Economic and Monetary Community, of which Chad is a member].

This is why, in 2018, the government implemented measures to contain the wage bill while allocating more resources to other areas. This was primarily achieved by containing benefits and allowances, without cutting wages themselves. Let me be clear: the ECF arrangement with Chad does not include any conditionality on the wage bill. But, the IMF supports the government's efforts in this area, because it is critical to restoring the ability of the government to implement fiscal policy and increase support for the poor.

What are the plans to help the most vulnerable in society?

The government aims to stem the decline in public spending, restore macroeconomic stability, and strengthen the fiscal position. This, in turn, is expected to create space to increase spending on investment and priority social areas, including health and education, which is needed to improve social conditions.

With a view to protecting the poor, including at a time when resources are scarce, the ECF includes quarterly floors on spending in social sectors. The targets aim to steadily increase the share of total spending allocated to social needs.

The issue of corruption is one that a lot of countries are grappling with, particularly low-income and developing countries. How is Chad addressing its governance issues?

There is significant room to improve governance in Chad and reduce the scope for corruption. The government recognizes the importance of reforms in this area to help restore macroeconomic stability and support inclusive growth.

The IMF and other partners aim to support the ongoing efforts to increase transparency, including in the reporting of oil revenues; improve public financial management; and strengthen tax and customs administration. In addition, the recent ratification of the United Nations Convention Against Corruption represents an important step that should be followed by other measures to reduce corruption and improve the business climate.

What is next for Chad?

Despite strong progress in the economy and support from the international community, significant risks and vulnerabilities remain: non-oil economic activity has yet to recover and development needs are very large. Determined efforts by the government on a wide range of fronts, along with continued financial and technical support from Chad’s external partners, are needed to leverage the emerging signs of stabilization and achieve durable and inclusive growth. Sustaining fiscal prudence, strengthening the banking sector, and improving the climate for private sector activity are key in this regard.