Emerging Asia: Outlook, Challenges, and India's Growing Role, David Burton, Director of the IMF's Asia and Pacific Department

October 21, 2004

Director of the Asia and Pacific Department

International Monetary Fund

The Reserve Bank of India

New Delhi, October 21, 2004

1. Ladies and Gentlemen, it is a great pleasure to be here with you today. I would like to share with you some thoughts on the outlook for Emerging Asia, the policy challenges ahead, and the potential for India to play a greater role in the region's economy.

2. In considering the outlook and policy challenges, the focus will be on five issues relevant for India as well as the region as a whole: the potential impact of a slowdown in China; growing inflation pressures; erratic capital inflows; high levels of public debt; and the unfinished structural agenda. Let me first set the stage with a brief overview of regional developments.

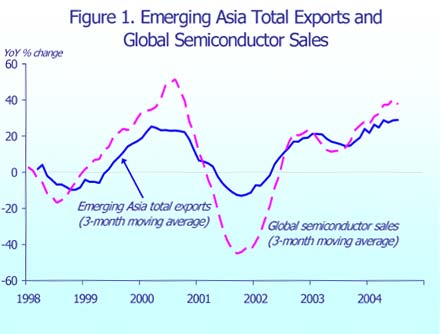

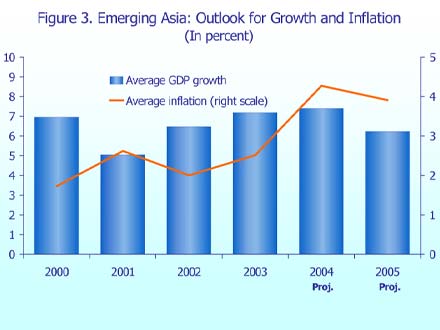

3. Emerging Asia continues to do well, with the latest WEO projections implying GDP growth for the region of roughly 7½ percent this year, slightly faster than last year's strong performance. Growth exceeded expectations in the first half of the year, as exports surged on the back of a strong recovery of the global IT sector (Chart 1). Competitive exchange rates also contributed to growth, as did macroeconomic policies that supported renewed strength in domestic demand, including investment in some countries. In India, growth has also been aided by last year's good monsoon. At the same time, with output gaps narrowing and global commodity prices increasing, inflation pressures have become more pronounced across the region.

4. On the external side, the positions of regional economies remain strong, even though reserve accumulation has decelerated following the sharp slowdown in capital inflows. Indeed, notwithstanding a massive unwinding of short-dollar carry trade positions across global markets in the first half of 2004, Emerging Asia's adjustment to higher world interest rates has proved manageable so far, with only a limited widening of bond spreads and a modest slowdown in new issuance. In some countries the rise in world interest rates and fall in capital inflows has even proved helpful, facilitating monetary management.

5. More recently, the pace of activity appears to be slowing. There are indications that China's breakneck expansion has eased somewhat, although a soft landing is not yet assured, a subject to which I will return. A "soft patch" in key industrial economies and a cresting of the electronics cycle are also beginning to dampen Emerging Asia's expansion, as is the rise in oil prices.

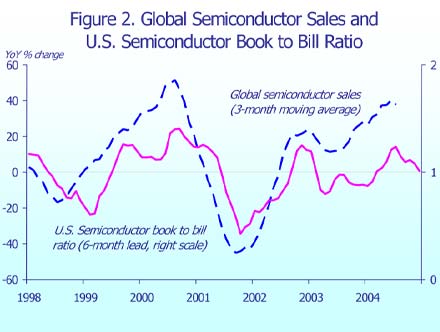

6. Looking ahead, some deceleration of growth is in the cards, as the world economy returns to a more sustainable growth path, higher oil prices take their toll on disposable income and domestic demand, and the policy stimulus in some countries is worked off. Forward-looking indicators for semiconductors and the technology sector more generally also point to slowing export activity across Emerging Asia (Chart 2). All things considered, regional growth could perhaps decline to about 6 ¼ percent next year, reflecting the increase in oil prices since then. Headline inflation is now expected to be broadly unchanged, in the vicinity of 4 percent (Chart 3).

7. Moreover, the balance of risks is tilted toward the downside. Geopolitical risks continue to be a concern. Growth in Emerging Asia could be threatened by even further increases in oil prices (especially if driven by supply disruptions rather than stronger demand), as well as weaker growth in advanced economies and a sharper-than-anticipated slowdown in the electronics sector. A harder landing in China than currently envisaged could also reduce intra-regional export demand. And inflation dynamics could deteriorate beyond expectations if high commodity prices persist. The last two points bring me back to the five issues on which I want to focus.

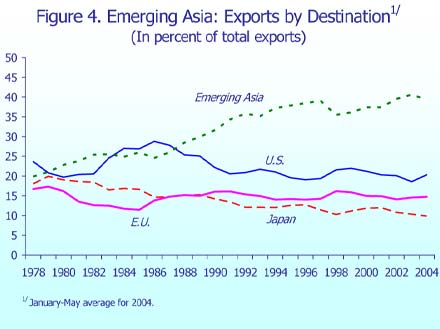

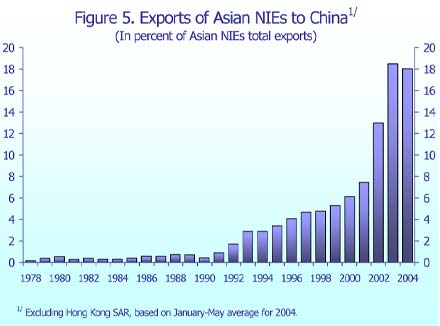

8. Issue One: The potential impact of a slowdown in China. China's emergence both as a production hub for the region's exports to the rest of the world and as a final export market has been key to the rise of intraregional trade and the closer links across economies in Emerging Asia (Charts 4 and 5). Developments in China are thus having an increasing impact on the rest of the region, and it is hardly surprising that China's efforts to achieve a soft landing are being watched closely around Asia, and indeed around the world.

9. What are the prospects for a soft landing? The Chinese authorities have taken a range of measures to slow investment from its unsustainable pace in 2003 and early 2004. These have included conventional steps to tighten liquidity, though considerable reliance has also been placed on administrative measures to curb investment in overheated sectors. Data for the second quarter suggested that fixed asset investment was slowing, and money and credit growth appeared to be moderating. Import growth also appears to have slowed. However, recent data also suggest that fixed asset investment may be picking up again. This is supported by anecdotal evidence that administrative measures have not been fully effective in slowing investment in the most overheated sectors. Data on production and investment for the third quarter due out very soon may help to clarify this picture. But at this point, it cannot be ruled out that further measures may be needed to bring about a softish landing. Failure to secure a soft landing in the near-term increases the risk of a hard landing down the road.

10. What would be the effects on the region of a bumpy landing in China? Preliminary research by the IMF staff suggests that the impact on the rest of Asia would probably not be large. For example, in a scenario where a sharp cutback in investment leads GDP growth in China to slow by more than 4 percentage points, and China's import growth for domestic consumption to slow by 10 percentage points, growth in the rest of the region would decline by about ½ percentage point. The impact on growth in India would be smaller—amounting to perhaps 0.2 percentage points—given the still-limited trade between the two countries. The impact would be even less for most countries if a slowdown in China were associated with a weakening of world commodity prices, as this would help the region's terms of trade. The reason these effects are relatively small is that much of the region's exports to China are merely processed there, and then sent out to the major industrial countries. So, provided that the outlook for the global economy remains positive, the impact on the region of a China slowdown driven by a cutback in investment should be manageable.

11. Issue Two: Deteriorating inflation dynamics. Since end-2003, CPI inflation has increased in most of the economies in the region, on average by about 1¾ percentage points. And headline inflation has now reached an average of 4½ percent. This pickup appears to reflect mainly rising commodity prices rather than domestic demand pressures, with little evidence so far of second-round effects setting in.

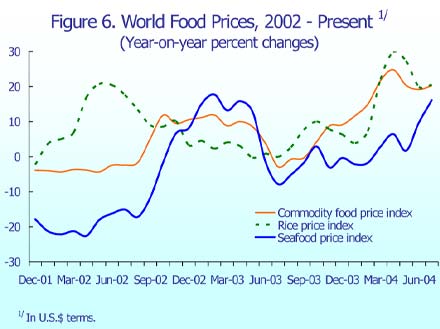

12. Food prices have been the main driving factor in most cases. International food prices have increased significantly this year, partly because of shortages in China and adverse weather conditions in major exporters, and partly because of rising world demand (Chart 6). Overall, increases in food prices have accounted for over 1 percentage point of the inflation pickup. In India, however, food prices have played only a minor role in the increase in wholesale price inflation, with other commodity prices having a greater impact on inflation.

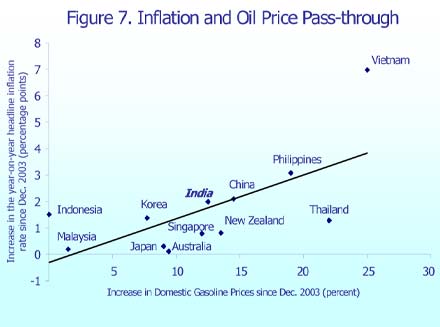

13. Higher world oil prices—which rose some 40 percent between December 2003 and September 2004—have also contributed to the increase in CPI inflation, but not as much as feared. Their modest contribution to inflation (on the order of ¼ percentage point for the region as a whole) reflects the smaller weight of energy compared to food in the region's consumption basket. It also reflects the incomplete pass-through in some countries, including India, as price controls and government subsidies have been used in many cases to shield consumers from higher world energy prices (Chart 7). This could entail either significant fiscal costs or further buildups of contingent liabilities to the budget if high international prices persist, and is an unsustainable strategy, especially in countries with large debts and deficits.

14. The challenge facing Emerging Asia's economic policymakers is how to respond to rising inflation so as to prevent "second-round" effects from taking hold, without unnecessarily compromising growth. In countries where the underlying strength of domestic demand remains a concern and inflation expectations are well anchored, the risk of the supply-side shocks feeding into "second-round" inflation is probably limited. In these circumstances a wait-and-see attitude is probably appropriate. In other countries, where demand has been growing rapidly or where inflation expectations are less well anchored, monetary policy has rightly begun to be tightened. In fact, in some of these cases, additional monetary tightening may well be necessary. Such further tightening, however, could complicate exchange rate management. This brings us to the next issue.

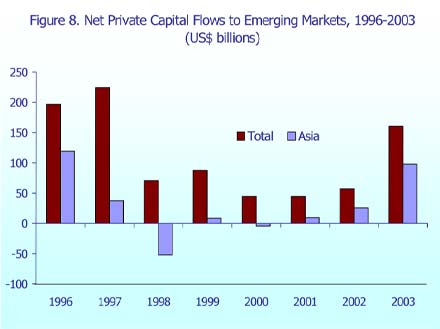

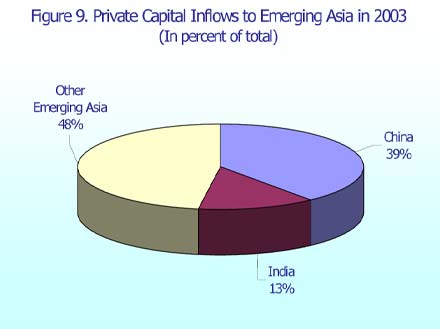

15. Issue Three: Surges in capital inflows. Between early 2003 and the end of the first quarter of 2004, Emerging Asia experienced a strong revival in private capital inflows, partly as a result of favorable interest rate differentials (Chart 8). Pull-factors included stronger macroeconomic fundamentals in many countries (including current account surpluses and ample war-chests of official reserves) and progress in financial and corporate restructuring. Expectations of regional currency appreciation were another important factor attracting capital inflows. China accounted for the bulk of these flows, but India was another major destination (Chart 9).

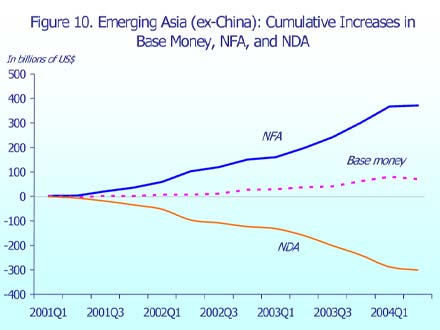

16. Although capital flows to Emerging Asia slowed significantly in the second quarter of 2004, the earlier pickup has reminded Asian policymakers that surges in capital inflows are a "fact of life" for vibrant economies. Policymakers were also reminded that dealing with capital inflows may involve difficult trade-offs between internal and external policy objectives, that is to say between inflation and competitiveness. Concerned that exchange rate appreciation (and possible overshooting) would put export-led recoveries at risk, policymakers reacted to last year's inflows by intervening heavily in foreign exchange markets, further boosting official reserves at Asian central banks. To limit its potential inflationary impact, much of this intervention was then sterilized (Chart 10). With subdued inflation and low interest rates, and the duration of the inflows limited, this strategy worked last year, and its text-book side-effects (one-way bets on exchange rates, and quasi-fiscal costs) remained manageable.

17. Should capital flows to Emerging Asia pick up again—and there are already signs this is happening, including here in India—policymakers in the region are likely to face a greater challenge in meeting internal and external objectives simultaneously. As we have seen, headline inflation has been rising across the region, and in some countries inflationary expectations may be beginning to respond. This makes containing the inflationary impact of inflows even more important. However, the scope for further sterilizing exchange market intervention may be limited, as it will involve—against a backdrop of rising interest rates— mounting quasi-fiscal costs and will likely encourage further inflows.

18. In these circumstances, and especially with buoyant recoveries and strong external positions in most countries, more flexibility in exchange rate management would need to be part of an appropriate response. This would allow monetary policy to be better geared toward controlling inflation. It would also reduce import costs, thereby improving consumption and investment opportunities. Greater flexibility in exchange rate management would in addition contribute to resolving global current account imbalances, which continue to cast a shadow over the global recovery. Let me turn now to my last two topics concerning policy challenges over the longer term.

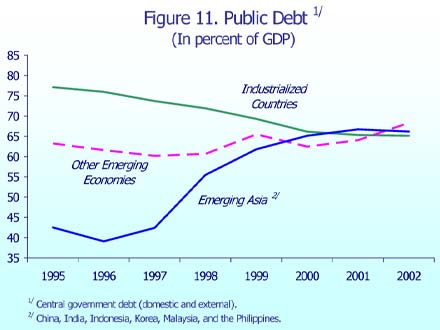

19. Issue Four: High levels of public debt. Heavy debt burdens continue to be a threat to medium-term economic performance in many countries in the region. Emerging markets as a whole have ratios of total debt to GDP that are now higher than the industrial countries—and much higher as a percent of government revenues (Chart 11). The growth in public debt in the second half of the 1990s has been particularly rapid in Emerging Asia, from some 40 percent of aggregate GDP in 1996 to about 65 percent now. Indeed, Asia now has a debt to GDP ratio significantly larger than Latin America and the group of transition economies. This is in part the result of the recapitalization of banking systems after the 1990s financial crisis in the region. In India, though, the high debt level is the result of fiscal deficits that have persisted over a long period.

20. I do not have to tell you that high public debt ratios are a drag on the economy. They keep borrowing costs high, discourage private investment, and constrain the flexibility of fiscal policy—often to the detriment of needed social and infrastructure spending that can help tackle poverty, or the pursuit of welfare-enhancing (but budget-unfriendly) trade reforms. They also make economies vulnerable to rising global interest rates—particularly a concern now. And ultimately, of course, they can threaten financial stability.

21. Asia needs to use the present period of strong growth to reduce fiscal imbalances, and lower this fiscal vulnerability. Some countries in the region have made noteworthy progress in putting their debt ratios on a declining path, but even in these more remains to be done. In a few others, including India, debt levels have not yet come down, even if modest progress has recently been made in reducing fiscal deficits. Effective fiscal reform—though never easy—need not be just a painful and unpopular exercise in austerity. The experience of a large number of countries—including India during the 1990s—shows that fiscal adjustment can go hand in hand with faster growth and reduced poverty if it is done right. Tax reforms can both raise revenues and improve incentives to save, invest and work. And cuts in unproductive spending can free up scarce resources for public and private investment, in particular if accompanied by broader structural reforms.

22. Issue Five: The unfinished structural reform agenda. This is a familiar refrain, but one which bears repeating because of its importance. Financial and corporate restructuring has proceeded at an uneven pace across the region. Notwithstanding some improvements, many banks and corporations remain saddled by weak balance sheets, which holds back both bank lending and investment. In addition, legal and regulatory reforms in many Asian countries could have proceeded faster. The list of unfinished business includes, among other things, adapting effective bankruptcy laws, tightening prudential oversight, and improving disclosure and governance in the capital markets. Finally, much remains to be done to strengthen educational systems, develop infrastructure, and foster open and competitive markets. Action in these areas is crucial for improving the investment climate and competing successfully for FDI.

23. There is, of course, never an easy time to step up reform efforts. But there are times when doing so is significantly easier than at others. Global economic conditions continue to be favorable, with the world economy ready to chalk up its fastest growth in 30 years, and the outlook for Emerging Asia remains bright. Rather than allowing the benign environment to reduce the sense of urgency, these are the "good times" when it makes most sense to act. It would be a pity to lose momentum and not take advantage of a good opportunity.

24. In closing, let me turn to the particular challenges that India needs to meet to step up the pace of its development to an even higher level and to play a greater role in the regional economy.

25. Policies to put the public finances on a more solid footing and continue to safeguard price stability would provide the needed macroeconomic underpinnings. Reducing the borrowing needs of government would have the added benefit of freeing resources for private investment, improving financial intermediation and easing the path to full capital account liberalization. As numerous public statements by the leadership of the RBI illustrate, these points are well understood here.

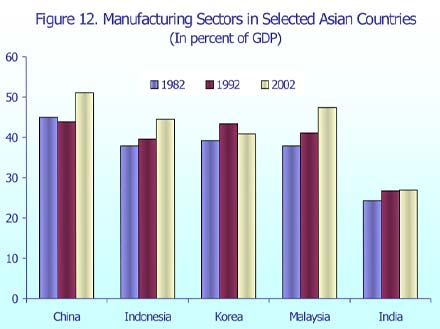

26. But to fully realize India's potential, and to meet the government's own ambitious goals, more is required. India will need to generate more than 100 million jobs in the next decade simply to keep the unemployment rate from rising. Stepped-up reforms to remove structural impediments to growth (notably, reforms to increase the flexibility of labor and product markets and catalyze bank intermediation) will be needed to boost potential growth, strengthen resilience to shocks, and develop a still-stunted manufacturing sector. Here, India is an outlier. The share of industry in GDP, at 27 percent, lags by Asia standards; in China, for example, the figure is more than 50 percent (Chart 12). Without greater dynamism on the supply side, employment creation and poverty reduction will have difficulty overcoming daunting demographics trends.

27. Greater trade liberalization and regional integration are also key to realizing India's potential and benefiting from greater integration into the regional economy. With the debate about India's emergence as a global leader in service exports dominating the news headlines, it may sometimes be overlooked that India remains a relatively closed economy. Exports of goods and services account for only about 15 percent of GDP and, while goods exports have been growing at an average annual rate of 12 percent since 2000, India still accounts for less than 1 percent of the world's exports. Much of India's recent export growth has been fueled by trade with Asia, in particular China, where India has managed to more than double its market share. Asia has also been the major beneficiary of the steady rise in India's imports, which have grown by close to 25 percent over the last few years. Yet, India still represents a small market for Emerging Asia's exports. As a result, this acceleration in Indian import growth has had only a limited impact on growth in the rest of Asia. But this will likely change in coming years. First, India's imports should continue to grow robustly as investment picks up. Second, India is committed to reduce tariff rates to ASEAN levels. And third, the recent establishment of SAFTA and the bilateral trade agreement with Thailand point to a deepening of regional trade ties.

28. As experience around the world shows, trade integration is central to sustained growth and poverty reduction. Lowering barriers to trade, within a multilateral framework of reciprocity and rules, has been the foundation of the tremendous expansion in global prosperity over the last 50 years. For India, further progress with trade liberalization would allow the economy to benefit from the dynamism of Emerging Asia, while integrating more fully into the global economy.

29. Ladies and Gentlemen,

I have touched on several policy challenges that India and other countries in the region share. India has a great deal to gain from continuing to tackle these common challenges with determination, and from assuming a larger economic role in the region and the global economy.

Thank you.

IMF EXTERNAL RELATIONS DEPARTMENT

| Public Affairs | Media Relations | |||

|---|---|---|---|---|

| E-mail: | publicaffairs@imf.org | E-mail: | media@imf.org | |

| Fax: | 202-623-6278 | Phone: | 202-623-7100 | |