Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey : IMF Extends Support for Senegal’s Plan to Be Emerging Economy

June 25, 2015

- National plan aims to make Senegal emerging economy, regional hub

- Authorities’ new three-year macroeconomic program backed by IMF

- Success hinges on robust efforts to implement reforms envisaged by plan

The IMF’s Executive Board renewed its support for Senegal’s economic and financial policies by approving a third straight endorsement of the West African nation’s policy program.

Tailor shop in Dakar, Senegal: country’s new program aims to further improve business climate (photo: Philippe Lissac/picture-alliance/Godong/Newscom)

WEST AFRICA

The authorities’ new three-year program underpins Senegal’s longer-term goal of attaining emerging-economy status by 2035.

The IMF Board approved on June 24 a new three-year Policy Support Instrument for Senegal. The Policy Support Instrument supports low-income countries that do not want—or need—IMF financial assistance but seek to consolidate their economic performance with IMF monitoring and support.

The instrument helps countries design effective economic programs that, once approved by the IMF Board, deliver clear signals to donors, multilateral development banks, and markets of the IMF's endorsement of the strength of a member country's policies.

Senegal’s new economic program is designed to help achieve the goals of the country’s overarching plan for the future. The “Plan Sénégal Emergent” is the authorities’ blueprint to help Senegal exit the trap of low growth and high poverty of past years. It intends to make Senegal a hub for West Africa by achieving high rates of equitably shared economic growth.

Ambitious yet realistic program

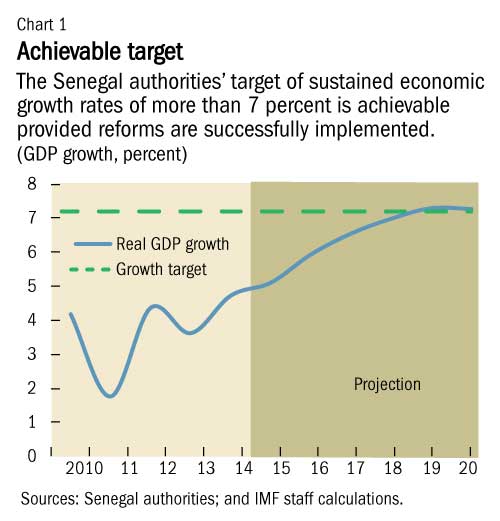

The authorities’ goals of sustained growth rates of more than 7 percent (see Chart 1) and of making Senegal a regional hub, underpinned by reforms envisaged by the plan, are achievable provided reforms are successfully implemented.

Hitting the plan’s growth targets would allow appreciable progress in improving living standards and reducing poverty. Early signs indicate positive momentum toward plan goals, thanks to progress in reform implementation and favorable external factors. However, more remains to be done to solidify this momentum, IMF staff said in its recent report on Senegal’s economy.

The Policy Support Instrument approved by the IMF has the overriding goal of macroeconomic stability through accelerated and sustained growth aimed at reaching higher living standards and thus reducing poverty. The instrument also meshes with the authorities’ objectives of

• Achieving high, sustainable, and inclusive growth;

• Preserving macroeconomic stability through prudent fiscal policy;

• Strengthening institutions and reforming the state;

• Improving the business climate and governance; and

• Building human capital and social protection.

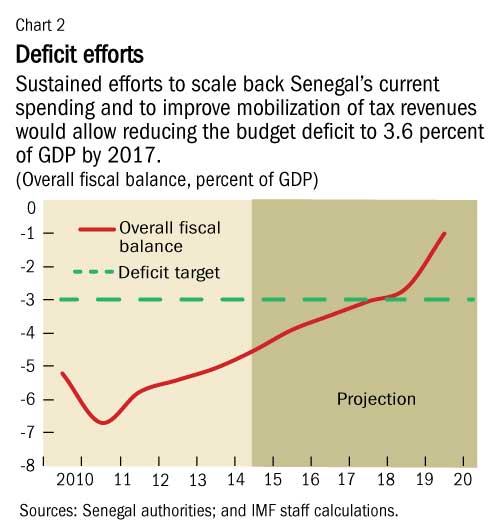

In 2015, Senegal’s fiscal deficit will be contained to 4.7 percent of GDP. Sustained efforts to scale back current spending and to improve mobilization of tax revenues would allow reducing the budget deficit to 3.6 percent by 2017 (see Chart 2).

Fiscal deficit goal

The authorities’ goal is to achieve the West African Economic and Monetary Union convergence criterion of a fiscal deficit of 3 percent of GDP by 2018. Public debt would not exceed 56 percent of GDP during the program period in the long run, which is consistent with a low risk of debt distress.

Key structural reforms aim at creating the fiscal space of investment related to the national plan, making delivery of public services more efficient, improving the impact of public spending through public financial management reforms, containing public consumption to generate the fiscal space for investment in human capital and public infrastructure, and strengthening social safety nets.

The three-year program also aims at improving the business climate, and at structural reforms to attract foreign investment and increase private investment. It also calls for constraining public consumption and increasing public savings to generate fiscal space for higher public investment in human capital and public infrastructure.

New elements

The new program supported by the Policy Support Instrument is the third of its kind. Two previous programs, implemented in 2010–14 and 2008–10, broadly achieved their macroeconomic objectives and helped preserve macroeconomic stability, but structural reforms lagged behind and weighed heavily on growth.

Four elements stand out in making the new program different from its predecessors.

• Strong ownership and national traction. The Plan Sénégal Emergent is firmly owned by the government—the president and finance minister were personally involved in its design—and shares broad popular support in the country. Strengthened ownership and improved accountability would contribute to improved outcomes. The Policy Support Instrument will help achieve the goals of the authorities’ development strategy.

• Innovative policy instruments. The program requires a good feasibility study before budgetary funds are released for new investment and this should improve investment efficiency—which is critical for growth. The debt anchor fixes debt accumulation to a preannounced five-year path and requires, in cases of deviation, that the path is regained within the next four years. This would help preserve debt suitability.

• Modern program design. The macroeconomic framework underlying the program will be based on the most advanced standard of presentation of fiscal accounts. Key assessment criteria will be calculated and monitored based on this new internationally accepted standard, for the first time in any West African country. This is an important step toward greater transparency and accountability and will strengthen investor confidence.

• Program support through peer learning. With full clarity on what needs to be done, the authorities have taken an unconventional step to learn how to implement the needed reforms. With help from the IMF, they organized a series of peer learning events with senior officials from Cape Verde, Mauritius, and Seychelles who have themselves implemented the reforms needed in Senegal. Such peer learning provides new form of hands-on assistance on key reforms. The next workshop will focus on public-private partnerships and involve South Africa and Mauritius, among other countries. Another workshop on delivery units, with the World Bank and the possible involvement of the United Kingdom, Malaysia, Mauritius, and South Africa will follow.

Navigating the risks

The ambitious goals enshrined in Senegal’s national plan are achievable if the reforms are successfully implemented. The risks to the new Policy Support Instrument program are significant but manageable.

Slower-than-envisaged implementation of reforms to curb unproductive public consumption and delays in raising expenditure efficiency may endanger the planned fiscal consolidation. Failure of tax reform aimed at improving incentives may lead to revenue shortfalls with excessive borrowing, and compromise debt sustainability. Delays in structural reforms, in particular in public financial management and in the energy sector and banking sectors, may reduce growth.

The risks to the program are not only home based. Continued volatility in oil prices may affect revenue targets and subsidies. Spillovers from regional shocks, including Ebola and extremism, may become more pronounced. Weather conditions can affect agriculture, and slower growth in trading-partner countries may reduce demand for Senegal’s exports.

The authorities intend to mitigate these risks and navigate the headwinds with sound macroeconomic policies, including the use of a debt anchor and the expansion of precautionary reserves; guidance from peers; and continued policy advice from the IMF.