Typical street scene in Santa Ana, El Salvador. (Photo: iStock)

IMF Survey: Suriname: Reforms Drive Economic Turnaround

January 10, 2013

- Homegrown program implemented in midst of financial crisis

- Suriname poised to grow at sustainable pace, without risk of overheating

- Authorities turning to deeper, far-reaching structural reforms

Despite the ongoing global slowdown, Suriname has put in place a strong, homegrown adjustment program that is helping to turn around its economy.

Workers at gold processing plant in Saramacca District, Suriname, where most of the production is for export (photo: Ranu Abhelakh/Reuters/Newscom)

Caribbean Conference

A recent conference paper by IMF economists reviews the measures taken by the authorities and highlights the country’s key achievements—a unified foreign exchange market, price stability, and significant fiscal gains.

Suriname’s recent experience with macroeconomic stabilization also presents a positive example for the Caribbean region of how meaningful and comprehensive adjustment is possible, provided that it is well designed, properly sequenced, and implemented by the government with commitment and resolve.

The three-day conference, hosted by the Central Bank of Suriname, focused on the Caribbean’s challenges and policy options.

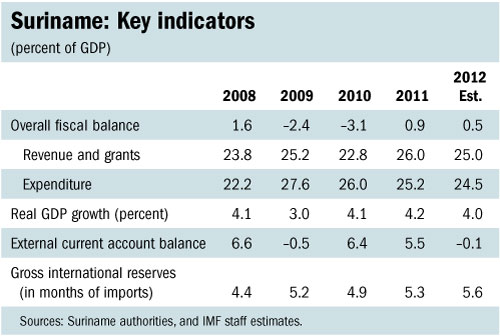

According to the IMF’s most recent assessment of Suriname’s economy, economic activity remains strong, and inflation pressures have abated considerably. Suriname is estimated to have grown by 4 percent in 2012, buoyed by the oil and gold sectors, as well as public investment, the IMF said.

Impact of global slowdown

Suriname was not completely immune from the global financial crisis. Following a period of fast growth and favorable commodity prices, the recent crisis impacted Suriname primarily through the trade channel.

Suriname, located on the northeastern coast of South America with a population of 530,000, is highly dependent on three commodities: gold, oil, and alumina. Together, they account for about 95 percent of total exports. During 2008–09, GDP growth slowed due to weaker external demand and international price declines. At the same time, the fiscal position deteriorated markedly—tax collections fell and spending surged, mainly on wages. In effect, fiscal policy played a countercyclical role. Loose monetary policies accommodated the resulting deficit.

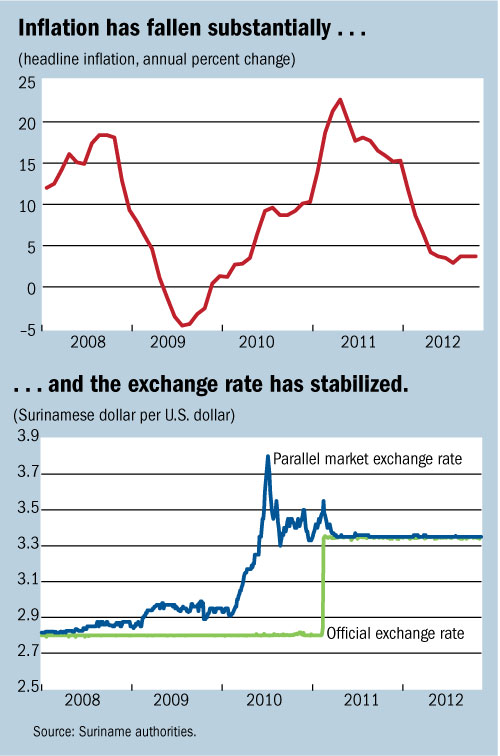

In early 2010, pressures from higher international food and fuel prices pushed up headline inflation to double digits. Moreover, reflecting excess liquidity and the heightened uncertainty associated with the upcoming 2010 elections, the spread between the fixed official exchange rate and the parallel market rate gradually widened to almost 40 percent. This caused a serious disruption in the market for foreign currency, with inflows bypassing the commercial banking system and going to the informal sector, and the government being deprived of the full value of revenues that are collected in U.S. dollars.

Stabilization measures

The new administration elected in mid-2010 took up the exchange rate imbalance as a high priority, in the context of a comprehensive adjustment program. With inflation on the rise and foreign currency scarce in the commercial market, the policy package aimed at restoring domestic balance and price stability. The authorities also saw the need for tight monetary and fiscal policies in order to avoid an inflationary spiral.

The adjustment program, which the IMF endorsed, was quickly implemented, starting with a 20 percent devaluation of the Suriname dollar in January 2011. The authorities raised taxes on domestic fuel, gambling, alcohol, and tobacco, while introducing temporary subsidies to protect the most vulnerable. However, they kept other spending under tight control, especially on goods and services and wages, in order to open space for higher investment in human capital and infrastructure.

The authorities also cleared the backlog of domestic arrears that had built up over the previous 12–18 months. On the monetary front, they raised the reserve requirement on foreign deposits to better control liquidity in the commercial banking system.

The authorities’ policy package has been quite successful, allowing Suriname to unify the foreign exchange market, restore price stability, resume robust growth, and realize significant fiscal gains. Moreover, the central bank has continued to accumulate reserves at a healthy pace, while total debt remains below 20 percent of GDP. Credit to the private sector has become more dynamic, and the regulation and supervision of the financial sector is being strengthened, following the enactment of the new Bank Supervision Law in 2011.

“In recognition of these achievements, two leading ratings agencies, Standard and Poor’s and Fitch, last year upgraded Suriname, even as other countries in the region and beyond faced serious downgrades of their foreign debt,” said Gillmore Hoefdraad, Governor of the Central Bank of Suriname, in a speech in March 2012.

Crucial structural reforms

With stability now in place, the authorities are turning their attention to structural reforms that will allow Suriname to be more resilient and grow in a sustainable way. An important medium-term objective would be to strengthen the structure of the budget by reducing the nonmineral deficit to at least precrisis levels. This would provide additional buffers and help protect the fiscal accounts against future price shocks. To this end, revenue diversification measures, such as the implementation of a value-added tax, will help broaden the tax base and stabilize revenues.

The authorities also continue to keep a watchful eye on public finances. Spending should be kept in check, while providing sufficient space to invest in infrastructure and human capital with the view to better integrate and diversify the economy. Meanwhile, given that the export capacity for commodities, particularly gold, is expected to expand significantly in the medium term, the authorities are working on establishing a sovereign wealth and stabilization fund to help them manage and save the expected increase in revenue for future generations.