<img src="-/media/17A7470EF3E046B680ED19AEF2C7B1C7.ashx?h=35"> PERU: Workers' Remittances of Peruvians Through Informal Channels

Introduction

Informality in Peru is present in a diversified set of economic activities, enterprises, jobs and workers that are not regulated or protected by the government. Informal economy, understood as informal activities underground and illegal activities, represents an important share of the Peruvian economy and workforce but complete statistics on the size, composition, contribution or other dimensions of the informal economy are not available. Currently, the Peruvian Balance of Payments (BOP) include only informal, small scale gold mining, remittances from Peruvians working abroad and remittances of Venezuelans working in Peru sent to their country through informal channels. The IIP does not include financial balances for informal activities.

Remittances From Peruvians Working Abroad

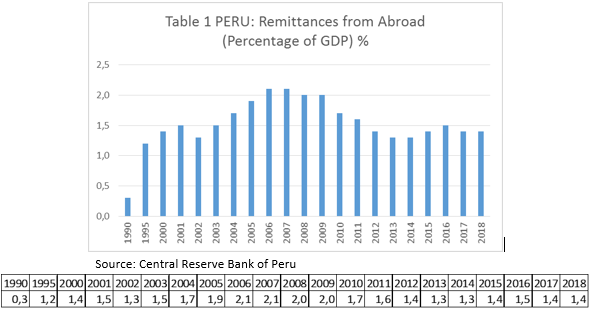

In accordance with the migration phenomenon in Peru, remittances increased from 0,3 percent of GDP in 1990 to a maximum of 2,1 percent of GDP in 2006 and 2007. From that period onwards, the percentage decreased in accordance with the evolution of migration; the economic situation in United States, Spain and Japan (main destinations of Peruvian migrants); and the improvement of job opportunities in Peru. Table 1 shows the evolution of remittances in Peru since 1990. Remittances sent to Peru through informal channels are estimated between 10 and 12 percent of total remittances. In the following paragraphs, we will explain the evolution of the register of remittances in the Peruvian BOP.

The compilation of total remittances before 2003 was not easy. The number of Peruvians living abroad was not known or estimated by any official agency. The remittances were mainly intermediated through Money Transfer Enterprises (ETFs) -which did not have regular statistics as needed- and through informal channels.

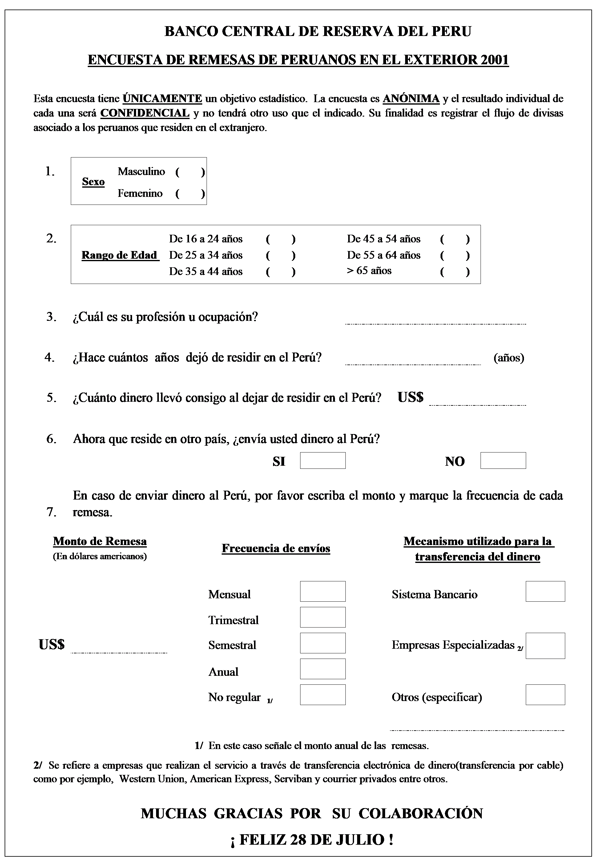

In July 1993 the Central Bank applied the first survey to Peruvians living in the United States, main destination of migration in those years. It was applied in 12 cities with the higher concentration of Peruvians. The Ministry of External Relations and the Peruvian Associations abroad allowed the selection of the cities. From that date, annual surveys were applied asking if the respondent send money to Peru and requiring an average remittance. The questionnaire is in annex 1. Those first surveys showed that Peruvian workers send money to Peru mainly through formal intermediaries (ETFs followed by banks) and that informal channels (pocket transfers) represented around 11 percent of total remittances.

The number of Peruvians living abroad legally or illegally was unknown. In order to include an estimation in the BOP, the Central Bank made a conservative estimate for 1985 of 100 thousand migrants, number that was subsequently updated with available statistics of the annual flow of Peruvian migrants from the Migrations Office. Considering that flow the estimated number of Peruvians living abroad was of 500 thousand for 1995. In ten years, 400 thousand Peruvians left Peru. The proportion of Peruvians that send money to Peru as well as the average remittance was obtained from the mentioned surveys.

It was also well known that migration to Japan had been important since the 1980’s but due to the difficulties to apply a similar questionnaire in Tokyo, the main financial intermediary of remittances from Japan provided an estimation. The number of Peruvians living in Japan was estimated in 45 thousand and total remittances from that country of US$ 140 million.

With the information from surveys to Peruvians in the USA and the estimation of remittances from Peruvians in Japan the first estimates of remittances were included in the BOP.

To verify the solidity of these estimations, in 1998 the Central Bank contracted a private research enterprise GRADE (Group of Analysis for Development) to make an independent calculation of the amount of remittances to Peru from abroad. The methodology applied considered a number of Peruvian workers abroad that potentially send remittances and an average remittance. The main sources employed were demographic census -number of migrants and their characteristics (age, gender, level of education, number of years abroad)-. Census data from United States, Spain, Japan, Mexico, Canada, Argentina and Chile were used. A number of illegal workers was also considered. The characterization of Peruvian migrants was useful to define a range of potential remittance taking into account information from the National Survey of Living Standards for 1997 prepared by a private research enterprise Cuanto Institute. The results of this study showed that previous estimated remittances were underestimated and the data series was corrected. This study did not provide information of the channel used to send the remittance.

For the following years, the number of Peruvian workers abroad was updated with the information of the Migration Office and the average remittance was updated taking into account the evolution of the economies where Peruvian migrants worked.

With the entry of Banks into the remittance business in Peru, the Superintendence of Banks and Insurance Enterprises (SBS) established norms for the declaration of information of remittances intermediated through banks and ETFs. Since 2003, the Central Bank took as the official source of information for the register of remittances the data provided by the SBS. Additional information from a financial intermediary of remittances from Japan and postal services provide the number of remittances intermediated through formal channels.

For 2003, a comparison of the remittances obtained from the SBS and those calculated through the previous methodology gave a difference of 10 percent, which was attributed to remittances that cross the Peruvian border through informal “agents”, relatives, friends and similar channels. This percentage is in a range known for other economies like Mexico (8 percent), Ecuador (14 percent) or Colombia (4 percent).

In 2011, the Center for Latinoamerican Monetary Studies and the Multilateral Investment Fund of the Interamerican Development Bank report an assessment of the remittance market in Peru. During their visit to Peru we were able to visit Banks and ETFs confirming this estimation. Annual interviews to Banks and ETFs, as informed participants of the remittance market, confirm the estimation that between 10 and 12 percent of total remittances enter to Peru through informal channels.

In 2012, the Ministry of External Relations, the National Institute of Statistics and the International Organization for Migration raised the first world survey to the Peruvian Community abroad. One of the results referred to the channel that Peruvians used to send remittances to Peru. The responses indicated that remittances were send through ETFs (68,0 percent), Banks (19,0 percent) and internet, friends or relatives or other not specified (13,0).

The reason for the stable and relatively low percentage of remittances sent through informal channels for decades has been the relatively high number of participants in the remittance business that made the cost of the service very competitive and the security to use a formal agent. When the ETFs were the main providers of the intermediation service there were around 12-14 agencies participating in this market. After 2000 when the Banks entered to the business, the cost of the service was further reduced and part of these ETFs left the business. The security to use a formal service plus a competitive cost made that Peruvians preferred to use a formal channel.

References

GRADE-Grupo de Análisis para el Desarrollo. Estimación del Volumen de Remesas Internacionales de Divisas. Informe para el Banco Central de Reserva del Perú. Perú. 1998

Center for Latin American Monetary Studies, Interamerican Development Bank Multilateral Investment Fund. Programa de Mejora de la información y procedimientos de los Bancos Centrales en el área de Remesas. Perú. 2011

http://www.cemla-remesas.org/informes/informe-peru.pdf

Ministerio de Relaciones Exteriores, Instituto Nacional de Estadística e Informática- INEI, Organización Internacional para las Migraciones- OIM. Perú: Resultado de la Primera Encuesta Mundial a la Comunidad peruana en el exterior 2012. Perú. 2013

https://www.iom.int/files/live/sites/iom/files/pbn/docs/Encuesta-OIM-web_Final.pdf

Annex 1