Jamaica and the IMF: The Power of Partnership and Ownership

May 2019

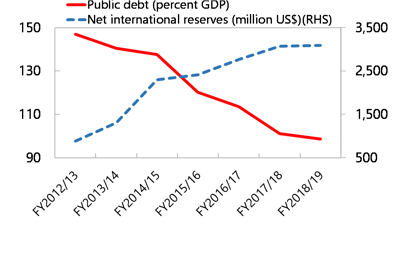

After gaining independence in 1962 Jamaica enjoyed strong economic growth and achieved middle-income status quickly. Three decades later incomes started to plateau, including following a massive financial crisis in the 1990s and a further setback after the 2008 global financial crisis. Challenges have ranged from policy missteps that led to high public debt to vulnerability to natural disasters, emigration and brain drain, and high crime. By 2013, Jamaica’s public debt had reached a historic high of about 147 percent of GDP, making it one of the most indebted countries in the world.

Program ownership and design

After a debt exchange in 2010 and yet another IMF-supported program that went off track, in 2011, the country was on the verge of an economic meltdown, with no access to international capital markets. Jamaica once again turned to the IMF in spring 2013 for financial support. With its preceding weak track record of reform, significant budget financing from international and development partners was less forthcoming. Jamaica needed a second debt exchange and a primary surplus of 7.5 percent of GDP to help stabilize the economy and address long-standing structural challenges.

The public said, “Enough is enough.” The Economic Program Oversight Committee was formed so that stakeholders from the private sector, unions, government, academia, and the media could come together to hold the government accountable for its reform commitments and fiscal discipline under the reform program. With that, as described by Finance Minister Nigel Clarke, “What began as an ‘IMF program’ became ‘Jamaica’s program’ with IMF support.”

Under the 2013 Extended Fund Facility and subsequently the 2016 precautionary Stand-By Arrangement (which was signed with a new administration), the Jamaican authorities over the past six years—with strong capacity-building support from international financial institutions and other partners—have made significant progress in stabilizing the economy and improving social outcomes. In particular,

- Fiscal and external sustainability have been restored. Jamaica has achieved a level of unprecedented fiscal discipline—across two governments from opposing parties—delivering a primary surplus in excess of 7 percent of GDP for six consecutive years. Public debt is down to below 100 percent of GDP for the first time since 2000/01. The tax reforms supported by technical assistance from both the IMF and the Inter-American Development Bank—which helped with administration and the switch from direct to indirect taxes—generated significant dividends during the period. This allowed for some net tax cuts in the most recent budget—a first within Jamaica’s living memory.

- Unemployment is at an all-time low, and growth is gradually improving. Business and consumer confidence are at all-time highs, while the unemployment rate has reached 8 percent—an all-time low—and poverty is slowly declining (although still high). The economy has grown for 16 consecutive quarters, and the pace is accelerating as sectors that were dormant are now producing (for example, mining).

- Capital and social spending are on the rise. The IMF-supported reform program placed a floor on social spending, which the authorities consistently exceeded. Capital spending, which was often crowded out, was completed at about 98 percent of allocation, with major ongoing road work.

- Financial sector reforms are taking hold. Several reforms—supported by IMF technical assistance—are completed or underway to further strengthen the securities dealers and financial sector more broadly. Foreign exchange auction systems are being tested, and proposed amendments to the Bank of Jamaica Act are being considered—to switch to inflation targeting.

The combination of commitment to reform from all walks of society—political, public, and private sector, as well as strong support from international and bilateral partners—has provided Jamaica a historic opportunity to reverse its course from unsustainable policymaking to setting an example for other small countries on how to take on a crisis and convert it to an opportunity. As the financial engagement with the IMF concludes later this year, such continued commitment, along with building the necessary institutions for policy continuity, should hold Jamaica in good stead for sustained higher economic growth.