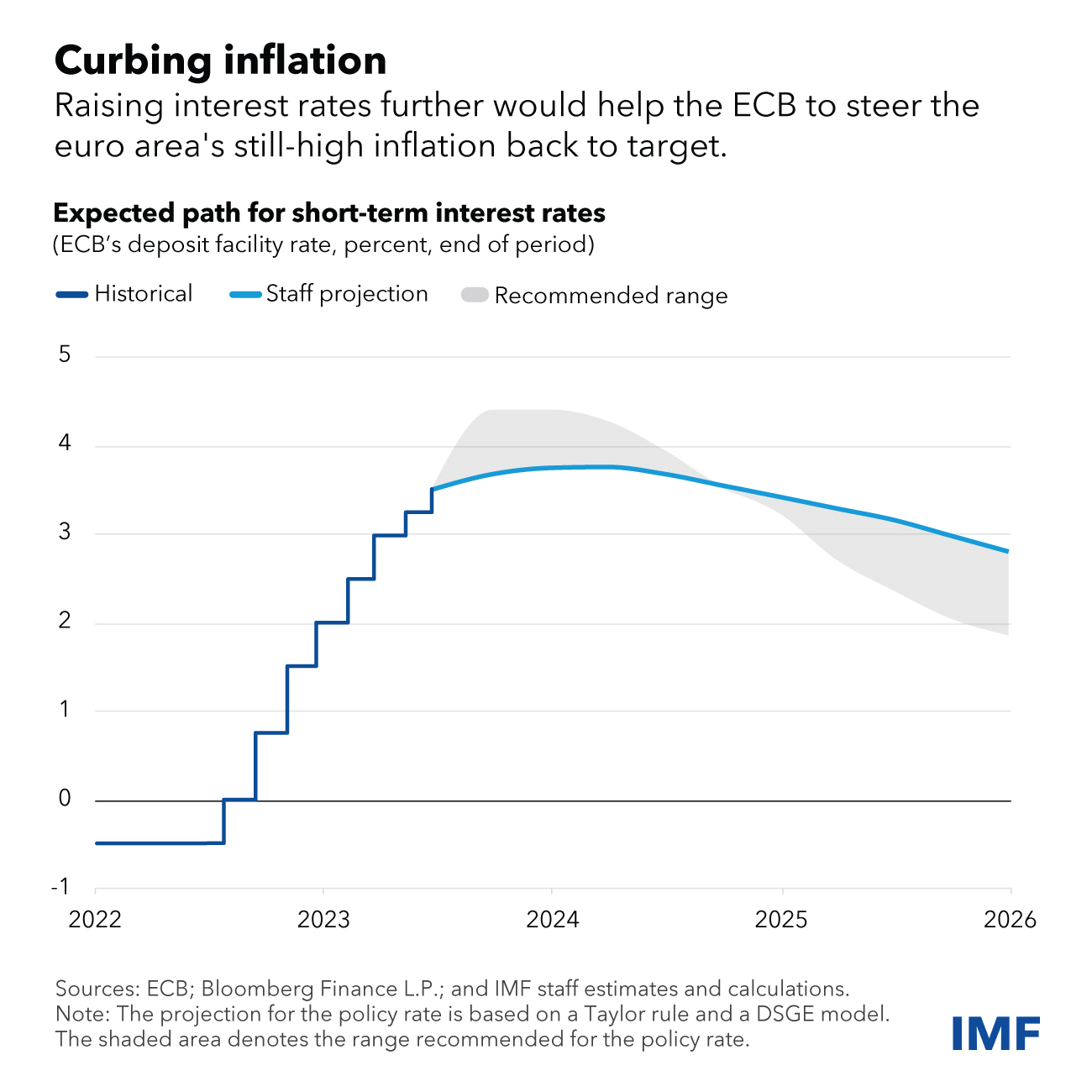

The European Central Bank could prevent inflation expectations from becoming unmoored and drifting upwards by continuing to raise its policy rate, as discussed in our recent report on the euro area. A further tightening of monetary policy in the near term would prevent much more costly measures later to bring inflation back to target.

As the

Chart of the Week shows, the ECB Governing Council has raised its deposit-facility rate eight

times, by a total of 400 basis points, since it started to tighten policy

in mid-2022. These decisive actions have helped keep longer-term

expectations well anchored so far.

If the ECB were to raise its policy rate further and possibly above the 3.75 percent peak that markets expect now, depending on incoming data, this would help significantly to prevent high inflation from becoming entrenched. In fact, inflation would converge more rapidly towards the 2 percent target and interest rates could then fall at a faster pace.

The original shocks to energy and food prices that catapulted inflation above target are dissipating. But inflation is still high, with prices in the euro area rising by 5.5 percent from a year earlier in June. Core prices—a more reliable measure of underlying inflationary pressures—were up by 5.4 percent. Core inflation in the three months to June was also still much higher than the ECB’s target, at 4.6 percent on an annualized basis.

Inflation pressures are likely to persist for some time. Workers will try to recoup losses in purchasing power by pushing for higher wages, while businesses are likely to seek to protect their profits by setting their retail prices to reflect higher labor costs. We do not see inflation coming back to target before mid-2025—and inflation could possibly prove more persistent if, for instance, inflation expectations shift upwards or the share of wage contracts containing backward-indexation clauses increases.

In the face of persistent inflation, the ECB should persevere in keeping monetary policy tight. For a while, the ECB should react more strongly when inflation comes in above expectations than it does when inflation is below expectations—adopting a so-called tightening bias.

A tightening bias would help prevent high inflation from becoming entrenched—a bad outcome that would ultimately force the ECB to tighten more and for longer to return inflation to target, causing a sharper economic downturn later.

Of course, the ECB should remain flexible given the economic uncertainties ahead and be ready to adjust course depending on the flow of data. The ECB’s meeting-by-meeting approach to making policy decisions rightly allows it to set rates based on the evolving inflation outlook, and incoming information on the drivers of underlying inflation and the strength of monetary policy transmission.