Economists will be studying the pandemic for generations to learn from the dramatic global downturn and the ensuing credit crunch, but one important lesson about the scope of action needed to contain the next global crisis is already coming into focus.

During the pandemic, countries often used all-out responses that combined large fiscal, monetary, and prudential policies like grants, credit facilities, and relaxed capital requirements. As we demonstrate in a new working paper, this kind of expansive response may be needed to support corporate borrowing and credit growth in major future crises that combine global supply and demand shocks.

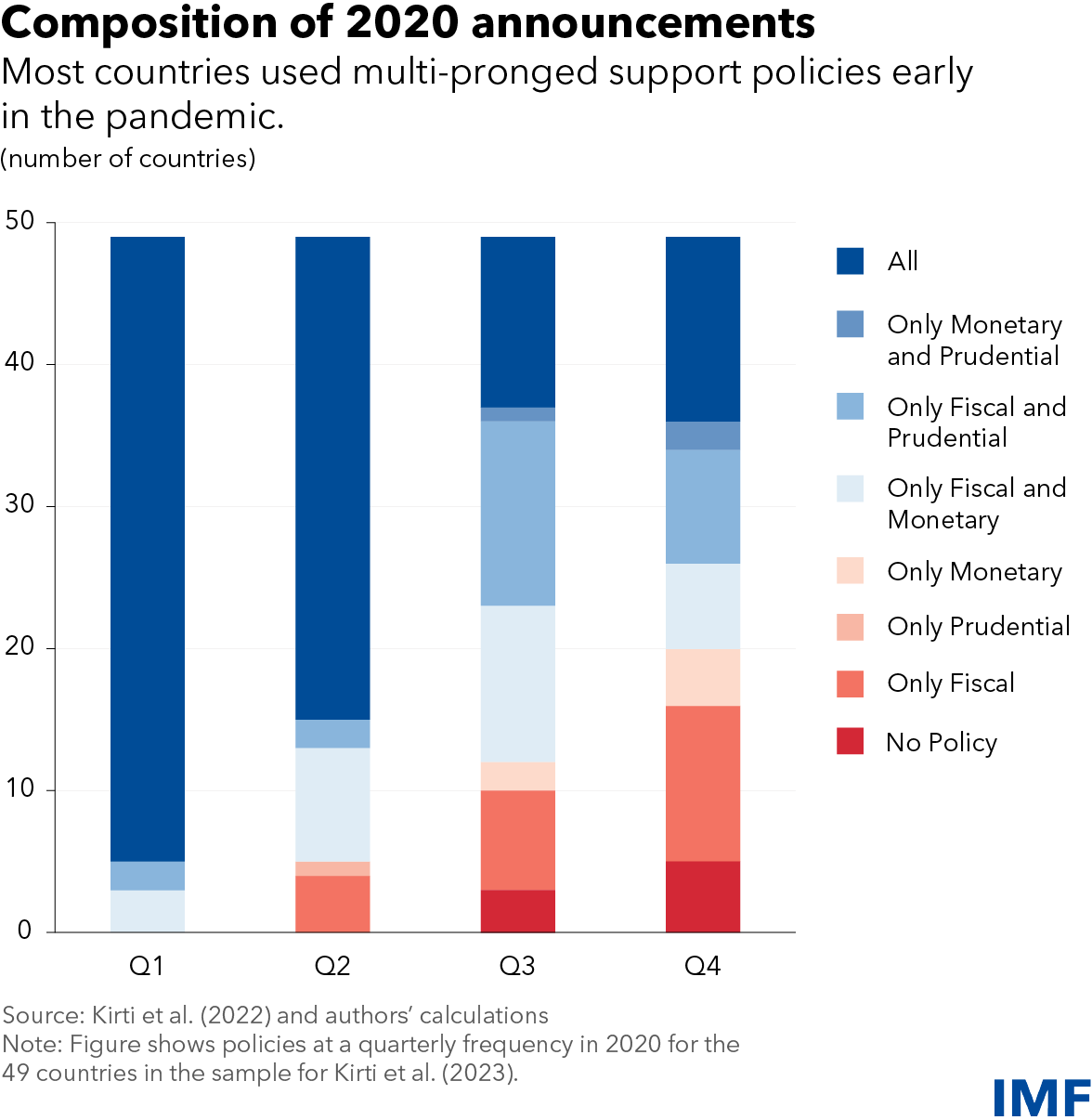

Our findings are based on an analysis using a dataset we made available last year tracking national announcements of economic and financial policy responses to the pandemic. Over the course of 2020, countries most frequently used packages of more than one fiscal, monetary, or prudential policy, while standalone policy announcements were rare.

As credit growth tanked early during the pandemic, policymakers in many countries aimed to stabilize bank lending to support their economies. Our analysis indicates that all-out packages boosted credit growth by a sizable 5 percentage points per quarter. Both size and scope were critical: even packages combining all types of policies, but where only some were large, were less effective.

Highlighting the importance of broad policy packages, all granular policy tools we tracked were more prevalent in successful packages than in others.

These all-out responses may have been effective because—faced by a large, unexpected, global shock—they pulled all levers relevant for credit growth. They eased binding constraints by shifting regulatory requirements. They incentivized incremental lending by addressing heightened concerns about credit risk. And they supported credit demand by lowering borrowing costs.

Within banks, the impact of policies was greater for those constrained by thin capital buffers.

Packages combining large fiscal, monetary, and prudential measures also translated into additional access to liquidity for bank-dependent firms. This allowed them to cover expenses—like wage bills—for two additional months while health measures limited sales.

While COVID-19 economic and financial policy packages were broadly targeted, they do not appear to have disproportionately benefited firms with poor performance prior to the pandemic.

Lessons for future crises

Our results underscore the importance of decisive action in terms of breadth and intensity of pandemic policy responses. In future crises that combine—as the pandemic did—negative supply and demand shocks with significant uncertainty, a similarly concerted, coordinated, all-out approach may have an important role to play in supporting the economy.

While there are benefits of an aggressive approach in response to a global shock like COVID-19, not all countries could respond in such a fashion. In particular, emerging and developing economies will likely continue to be more constrained, as they were in this episode.

To be sure, an all-out approach could also have unintended consequences. Large fiscal and monetary packages could support credit and the economy but also fuel sharp inflationary pressures. In countries with high debt, an increase in discretionary spending could strain debt sustainability. More work is needed to better understand how to calibrate the appropriate all-out response to minimize such costs.

—This blog includes research contributions by Yang Liu.