Technology, globalization, and global warming have changed the world, and taxation must keep pace. With a mouse click, individuals can move money across borders and corporations can transact with their affiliates across global supply chains. Production depends on intangible know-how assets that can be located anywhere. Employers and their employees can work in different countries. As income and factors of production become more mobile, and with climate change threatening our planet, countries face tax challenges that know no national borders.

Tax evasion and avoidance cause the loss of revenue that could have financed social spending or infrastructure investments. They also exacerbate inequality and perceptions of unfairness. Self-serving national policies of one country can affect others in damaging ways. If each sets its own tax policy without regard for the adverse effects elsewhere, all countries can end up worse off.

Our new Fiscal Monitor shows how better international coordination in three areas—taxing large corporations, sharing information on offshore holdings, and enacting fair carbon pricing—can benefit everyone.

Coordinating on corporate taxation

Widespread dissatisfaction with low tax payments by the world’s major multinationals (despite annual profits of 9 percent of global gross domestic product) spurred a groundbreaking agreement to modernize the existing and century-old international system. In 2021, 137 countries reached a breakthrough on coordination: the Two Pillars Solution under the Inclusive Framework. With 2022 set to be a crucial year for implementing the agreement—the object of live political debate in several countries—the Fiscal Monitor gauges its potential benefits.

Pillar 1 of the agreement says that a portion of multinationals’ profits must be taxed where the firms’ goods or services are used or consumed. This means that tech companies can be taxed where their customers are located, even if their employees are far from their customer base. In a world where digital commerce is now commonplace, this is a welcome development. While our report finds that the agreed reallocation of tax revenue covers only 2 percent of global profit of multinationals, this new taxation principle sets the stage for a more efficient tax than unilateral digital services taxes.

Pillar 2 establishes a global minimum corporate tax of 15 percent. By doing so, it puts a floor on competition, reducing incentives for countries to compete using their tax rates and for firms to shift profits across borders. Some nations will top up their tax on “undertaxed” profit to the minimum level, increasing corporate tax revenues by up to 6 percent globally. By reversing the downward trend of income corporate income tax rates, reduced tax competition could raise revenue by another 8 percent, bringing the total effect to 14 percent. Work should continue, however, to better adapt to low-income countries’ circumstances—for example, to simplify some aspects of corporate taxation, strengthen withholding taxes on cross-border payments, and share more country-by-country information on multinationals. For low-income economies to reap the benefits of recent changes, they need to adopt complementary reforms, such as removing wasteful tax incentives.

Coordinating on personal taxation

Much like corporations, the taxation of individuals (especially the wealthiest) also requires coordination across borders. Recent leaks of documents such as the Panama Papers and Paradise Papers revealed a massive stock of offshore wealth and widespread tax loopholes. And with the rise of digital assets that allow for even greater anonymity, the sharing of information is becoming more and more vital. Beyond the revenue loss, opaque offshore accounts designed to hide wealth facilitate the transnational transfer of corrupt proceeds.

Coordination can deliver tangible results, and 163 countries have agreed to exchange information under the Global Forum on Transparency and Exchange of Information for Tax Purposes. Yet, more can be done to improve the reliability of the information, our report notes. Countries should do more to promote beneficial ownership registries—information about who really owns or controls a company.

Some countries have already established such mechanisms. But how they are implemented matters—information from the registries should be centralized in a public database. Effective use of the information remains critical for enforcement and low-income countries will need to develop more know-how to realize the benefits from transparency.

Another recent phenomenon that calls for greater coordination is the increasing mobility of the labor force. Opportunities for cross-border remote work have expanded, along with the number of economies offering digital-nomad visas targeted at high-skilled individuals. Estimates suggest that cross-border remote work—given existing differences in tax rates across countries—reallocates personal income tax revenue between countries by 1.25 percent of global personal income tax revenue. Coordination will gain importance in the future to ensure a consistent tax treatment between countries where employers and employees reside.

Coordinating on carbon pricing

Concrete coordinated action is even more urgent to fight climate change, because the rapid increase in greenhouse gas emissions is causing us to speed toward disastrous global warming of more than double the limit that scientists consider tolerably safe.

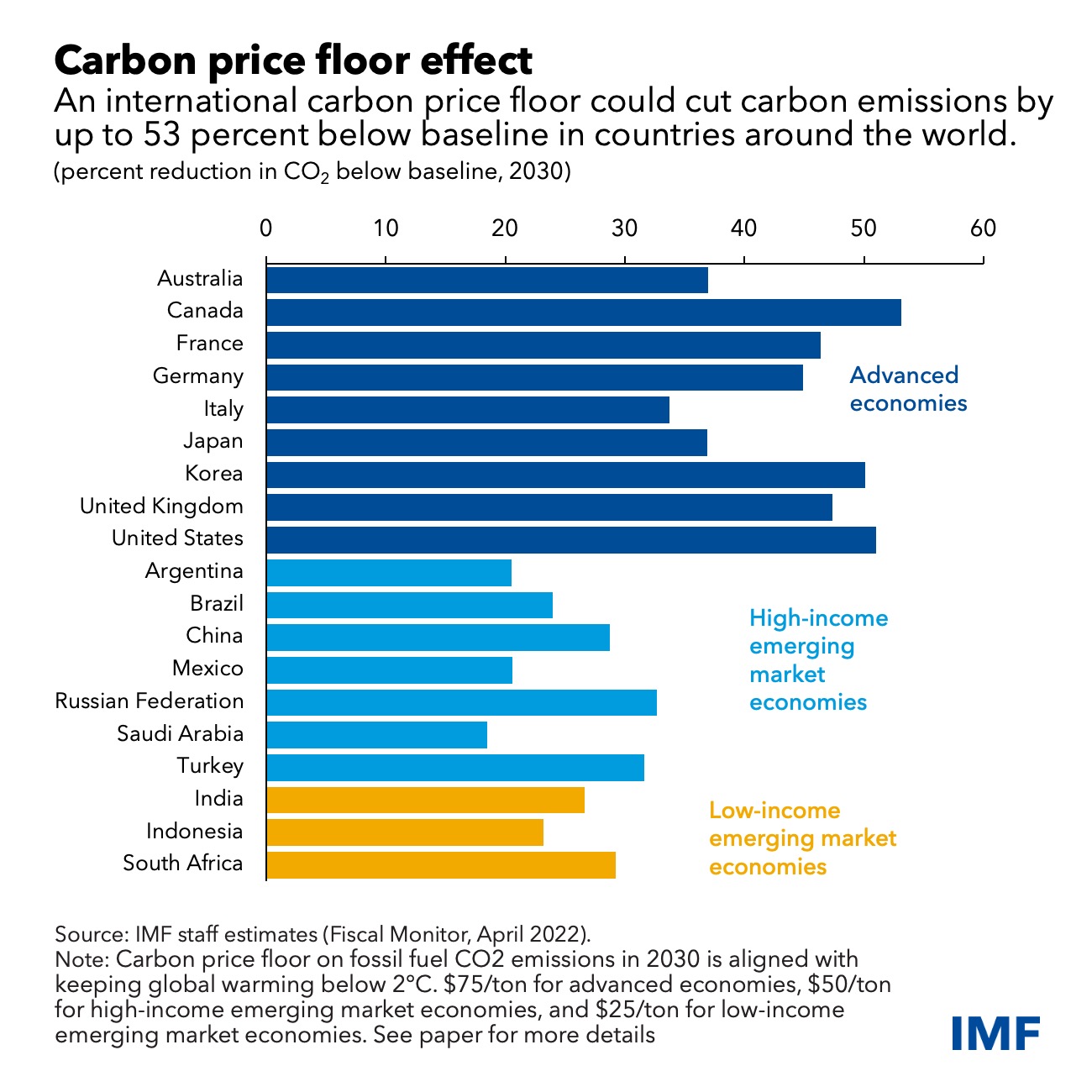

An international carbon price floor is analogous to a global minimum corporate tax. But here a few key emitting countries can speed up coordination and make an important start. Such a floor would discourage emissions and alleviate competitiveness concerns. It would limit global warming to 2 degrees Celsius or less while accommodating alternative approaches (such as regulation, through the calculation of equivalent prices). An international carbon price floor could also allow differentiated responsibilities for nations depending on the income level.

As governments grapple with an acceleration of energy prices caused by the war in Ukraine, they should support people (ideally through targeted transfers or lump-sum utility bill discounts) rather than subsidizing fossil fuel consumption. And near-term responses should not detract from efforts to invest in renewable energy and greater energy efficiency. Countries that have already set a gradual rising path for carbon taxation should stay the course—the envisaged increases are far smaller than recent gyrations in prices, which stem from global shocks. Revenues should be used to ensure that all workers and communities benefit from the green transition. At the international level, agreeing on a carbon price floor (or equivalent measures) remains urgent.

History tells us that the value of collaboration is even greater as we counteract the economic consequences of pandemics or conflicts. In the same cooperative spirit of scientists working together across borders to fight COVID-19, now is the time to better tax corporations, fight tax evasion, and act for a greener and fairer world.