The economic recovery continues, though the pace of the recovery has slowed. Notably, our global forecast was lowered in January to a still-healthy 4.4 percent expansion this year. This was down from an October projection of 4.9 percent, amid reduced growth prospects for the United States and China, the two largest economies. Meanwhile, inflation has been higher than expected in many economies, while financial markets remain volatile as geopolitical tensions have increased.

High-frequency economic indicators offer evidence that the growth momentum has slowed going into 2022—in line with expectations of a weak start to the year, owing to the spread of the highly contagious Omicron variant and persistent supply-chain disruptions. In this respect, we project activity to pick up in the second quarter of the year as the variant’s impact fades.

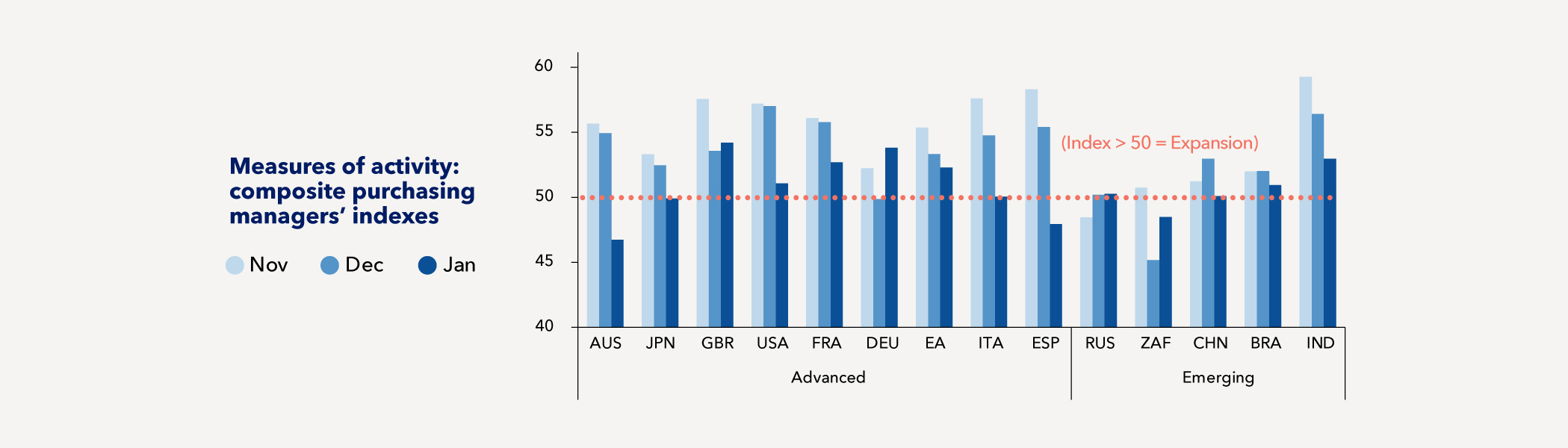

As the Chart of the Week shows, composite gauges of manufacturing and service sector activity in many Group of Twenty economies highlight the recent softening. In some economies, the purchasing managers’ index indicated a slower pace of expansion in January compared with the prior two months. A few PMI gauges, including Australia and Spain, even swung below 50—the threshold signaling a contraction—although the declining effect of the Omicron variant will hopefully mean that the dip is short-lived.

In our recent report to the G20 , we examine these developments for G20 advanced and emerging market economies.

We note that advanced economies have experienced pandemic strains and mismatches between supply and demand that have continued to boost inflation and weigh on the recovery. Temporarily reduced mobility as a result of the rapid spread of the Omicron variant has put a damper on service sector activity, including in the euro area, Japan, and the United Kingdom. Continued supply disruptions have also weighed on activity in the euro area and United Kingdom. And while the recovery has been strong in the United States, the virus has dented consumer sentiment somewhat.

In emerging economies, pandemic curbs and reduced policy support are weighing on activity. In addition to the PMI declines, some other recent data point to softer momentum, such as lower industrial production in Brazil. In China, tighter mobility restrictions have resulted in weaker-than-expected retail sales, while a decline in real estate investment and tighter travel restrictions have also represented headwinds.

Meanwhile, inflation has been higher than expected in many economies, while financial markets remain volatile and geopolitical tensions have increased. Obstacles such as these, combined with reduced growth momentum, show why the world needs strong international cooperation to end the pandemic, navigate monetary tightening and shift focus to fiscal sustainability.