When it comes to central banks in Latin America, sometimes words can speak louder than actions.

This is because the public and investors rely on central bank communications to make economic and financial decisions. So, clear and consistent communications from a central bank about policy decisions and the economic outlook are essential to guide market expectations.

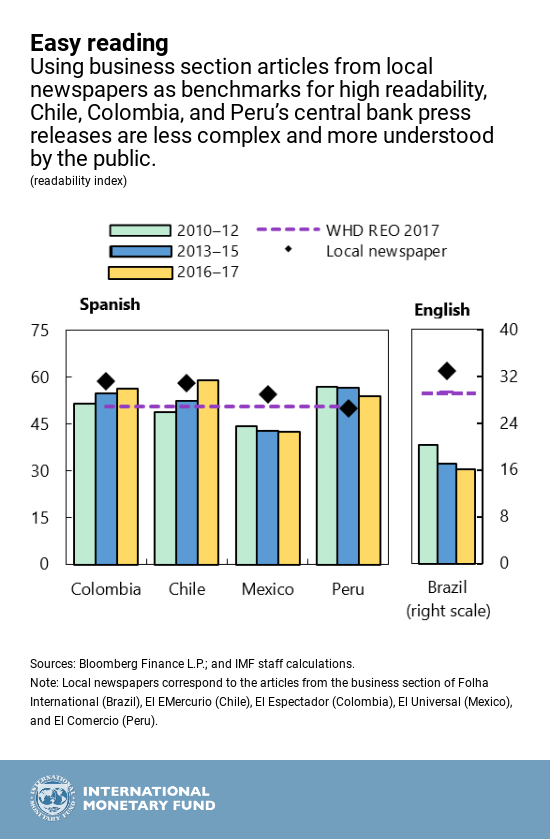

This chart of the week from the Regional Economic Outlook: Western Hemisphere shows that, it is not just a matter of how much central banks communicate, but the quality and clarity of information as well. Using articles from the business section of local newspapers as benchmarks for high readability and clarity of communication, we found that central banks in Chile and Colombia have improved their communication over the years.

Chile’s central bank press release language scores the highest in the readability score compared to peer countries.

Quality over quantity

In Latin America, central bank communications are broadly similar and mainly consist of press releases, publishing policy meeting minutes, quarterly reports on the inflation outlook, and parliamentary hearings.

Recently, there has been a push across the region to improve the transparency of central banks. For example, in Brazil and Mexico, press releases to the public have become more detailed—providing a comprehensive explanation behind policies and inflation risks.

While transparency is good, wordy and dense documents, however, are not. They tend to be confusing to the reader and can increase uncertainty about future policy actions. We found that when banks communicate in the language more understood by the general public, their monetary policy decisions are seen as more predictable and credible.

This includes shorter statements with simpler words and sentence structure. For instance, we found that the text length of Chile and Peru’s central bank press releases are relatively shorter compared to other regional central banks. It comes as no surprise, then, that these countries communications scored a high ease of readability, as the chart shows.

How to communicate

So, what can the region’s central banks do to communicate more effectively? Central banks need to be more transparent and provide markets with explicit guidance and clarity on:

-

recent economic external and domestic economic developments and the central bank’s outlook on growth, inflation, and unemployment

-

balance of risks to the inflation outlook

-

where policies are going (whether interest rates will go up or down)

-

guidance on the conditional future direction of monetary policy

-

central banks’ objectives.

Enhancing transparency through better communication is vital for central banks because transparency helps to increase predictability of policies.

With predictability, the public can anticipate the central bank’s decisions, which can better align the public’s medium-term inflation expectations with the central bank’s objectives. This strengthens the impact of monetary policy changes and gives central banks more credibility.

Transparency and communications are not a panacea but, ultimately, implementing these strategies can help strengthen central banks in Latin America.

Related Links:

Communications Can Help to Get Financial Stability Off the Ground