August 13, 2018

Versions in عربي, 中文, Español, Français, 日本語, Português, Русский

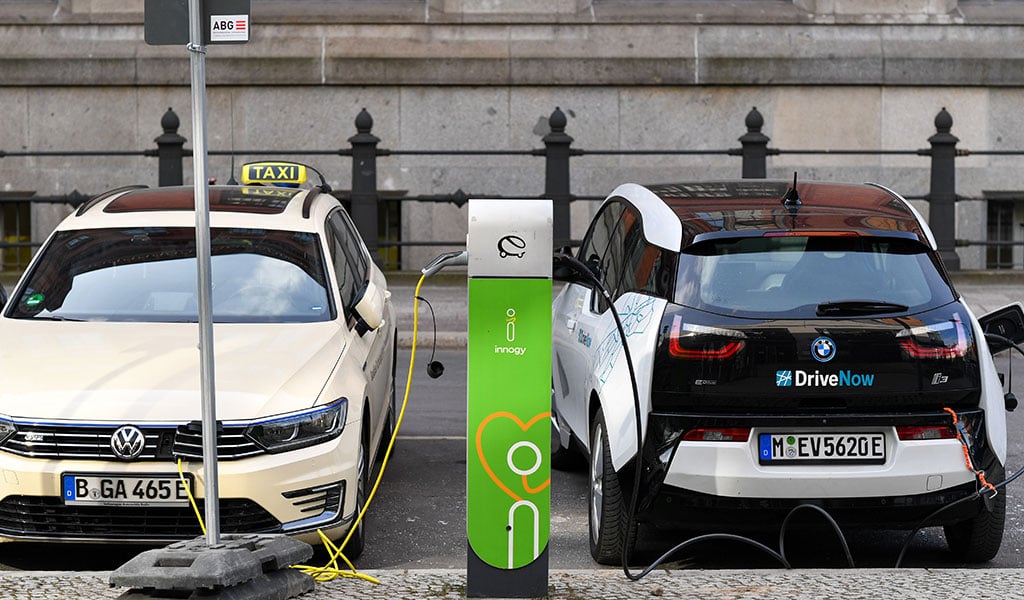

[caption id="attachment_24270" align="alignnone" width="1024"] Electric car charging station in Berlin, Germany: prices for lithium and cobalt—key ingredients in rechargeable batteries—are rising due limited supply and growing demand for electric cars (photo: Jens Kalaene/Newscom)[/caption]

Electric car charging station in Berlin, Germany: prices for lithium and cobalt—key ingredients in rechargeable batteries—are rising due limited supply and growing demand for electric cars (photo: Jens Kalaene/Newscom)[/caption]

The surge in demand for electric cars has been fueled in part by the falling costs of lithium-ion batteries—driven by technological progress—which power everything from electric cars to smartphones.

Lithium and cobalt are critical components in batteries for electric cars. The rapid growth in the demand for rechargeable batteries has now driven up these raw material prices, and given rise to concerns about potential cobalt and lithium scarcities that could slow the rollout of electric vehicles.

The price of cobalt is expected to remain high due to limited supply and growing demand.

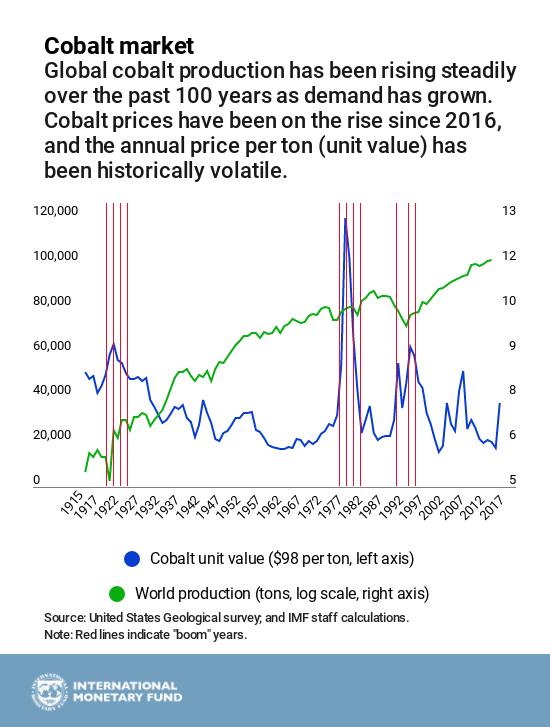

The price of lithium carbonate increased by more than 30 percent in 2017. Even more staggering is the upswing in the price of cobalt, which has risen by 150 percent between September 2016 and July 2018. And as shown in our Chart of the Week from the April World Economic Outlook, cobalt price booms are not without historical precedent.

Unlike lithium, the price of cobalt is expected to remain high due to limited supply and growing demand. In 2016, more than 50 percent of the global supply of cobalt came from the Democratic Republic of the Congo.

Cobalt prices have also been volatile due to insecure supply chains. The chart also shows that since 1915 there have been four price boom episodes. Those during 1978–81 and 1995–96 elicited sharp responses: world production grew by 54.1 and 36.1 percent in 1983 and 1995, respectively, significantly higher than the 50-year average of 4.8 percent. The uptick in prices since 2016 and futures prices for 2018–19 suggest that history may be repeating itself and production could yet again accelerate, at least temporarily. Indeed, cobalt prices have come down somewhat in recent months, following strong production increases in the Democratic Republic of the Congo and reduced demand from China.

Several developments could, however, limit this price volatility. These include increased recycling of cobalt and new primary production mining techniques.

Perhaps most important, battery technology is continuing to improve and could bring the surge in cobalt prices to a halt. One of the leading alternatives to the lithium-ion battery concept—the solid-state battery—would mean smaller and more-energy-dense batteries that do not need cobalt.

Continued research and innovation in this area could spur further progress in the development of electric vehicles and portable electronics.