For companies and investors outside the United States, the dollar is often the currency of choice. Surprisingly, though, US banks play only a limited role in lending dollars to international borrowers. Most of the $7 trillion in banks’ dollar lending outside the United States is handled by banks based in Europe, Japan and elsewhere.

This is significant because these banks can’t easily tap the dollars deposited at their US subsidiaries to finance dollar lending outside of the country. Instead, the IMF’s recent Global Financial Stability Report found that they must rely heavily on less-stable funding sources to support their international dollar balance sheets, such as interbank deposits, commercial paper and swaps. The danger is that these sources of funding could dry up quickly in times of financial-market stress.

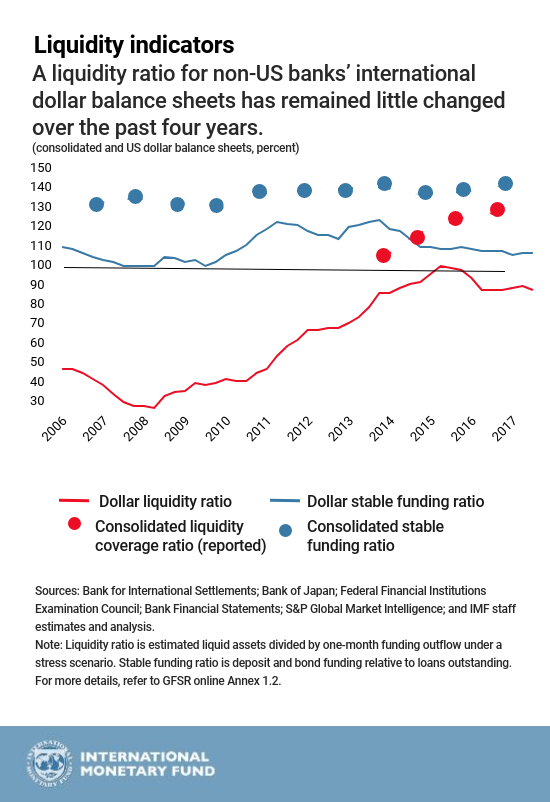

Global regulators have compelled banks to guard against such a loss of funding by improving their liquidity coverage ratios, a measure of banks’ ability to meet short-term fund outflows from reliable liquid assets.

Some banks may be overly reliant on potentially fragile cross-currency swap markets

These improvements applied to banks’ global consolidated balance sheets, which encompass their aggregate positions in all currencies. But a liquidity coverage ratio based on their international dollar balance sheets, which exclude US subsidiaries, reveals a different picture. This ratio is meaningfully below their consolidated liquidity ratio. An estimated stable funding ratio, a measure of stable funding relative to the level of loans, is similarly much lower for international dollar positions than for their overall balance sheets.

Several forces are set to push up dollar funding costs. The US Treasury is issuing more T-bills, potentially putting upward pressure on the interest rates non-US banks must pay for short-term dollar funding. The new tax law is expected to encourage US corporations to repatriate cash and possibly shift cash out of bank funding instruments. And these developments are taking place against the backdrop of the Federal Reserve’s interest-rate increases and the gradual reduction of securities holdings on its balance sheet, which would ultimately lift funding costs for all borrowers. Not all banking systems are equally vulnerable to strains in funding markets. For example, our analysis suggests that dollar liquidity ratios at French and German banks are not as strong as their peers. Another concern is that some banks may be overly reliant on potentially fragile cross-currency swap markets. For example, swaps cover over 30 percent of Japanese banks’ dollar funding needs. While much of their swap borrowing is long-term, banks’ ability to access this type of funding may be compromised under stress conditions.

The combination of this market tightening and the international dollar balance sheet vulnerabilities discussed above could trigger funding problems in the event of market strains. Market turbulence may make it more difficult for banks to manage currency gaps in volatile swap markets, possibly rendering some banks unable to roll over short-term dollar funding.

Banks could then act as an amplifier of market strains if funding pressures were to compel them to sell assets in a turbulent market to pay liabilities that are due. Funding pressure could also induce banks to shrink dollar lending to non-US borrowers, thus reducing credit availability.

Over the past decade, global and national policymakers have strengthened regulatory frameworks governing banks’ consolidated solvency and liquidity positions. However, country-specific liquidity regulations, while helping to strengthen national financial systems, may inadvertently restrict the flow of liquidity within banking groups.

Looking ahead, banks should ensure that currency-specific liquidity risks within individual entities in their banking groups continue to be managed effectively. Regulators should address foreign currency liquidity mismatches through more disclosure, currency-specific liquidity standards, stress tests, and resolution planning. Central banks’ swap lines, which are already in place to provide foreign exchange liquidity in times of stress, should be maintained, as a last resort backstop.