August 30, 2017

Versions in Español (Spanish), Deutsche (German), Français (French)

[caption id="attachment_21102" align="alignnone" width="1024"] A woman withdraws money from an automated teller machine in Italy: Some European banks have too many branches relative to assets (photo: Martin Moxter imageBROKER/Newscom)[/caption]

A woman withdraws money from an automated teller machine in Italy: Some European banks have too many branches relative to assets (photo: Martin Moxter imageBROKER/Newscom)[/caption]

European banking has made considerable progress in the past few years: Banks have built up capital, regulation is stronger and supervision has been enhanced. But profitability remains weak, posing risks for financial stability.

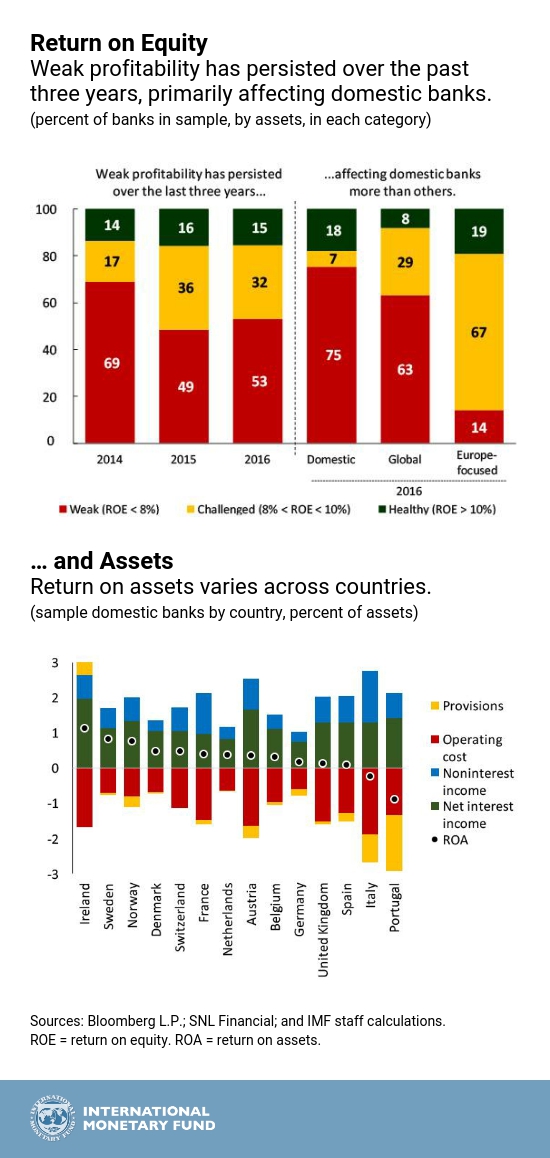

In a sample of more than 170 large European lenders with combined assets of $35 trillion, roughly half generated a weak return on equity in 2016, and banks representing only 15 percent of assets generated a healthy return on equity, defined as more than 10 percent. Weak profitability is also shown in a low return on assets for domestic banks in many European countries. The drivers of these weak returns reflect varying combinations of low income, high costs, or provisions needed to build buffers against non-performing assets.

Impact on stability

The economic upturn in Europe should boost profitability as interest rates rise, loan-loss provisions fall, and lending opportunities increase. But the October 2016 Global Financial Stability Report found that a cyclical recovery is unlikely to be enough to fully restore bank profitability.

Why is low profitability a threat to financial stability? Consistently unprofitable banks are unable to build up reserves against unexpected losses and often find it difficult to raise capital in times of need. Weak returns also limit banks’ ability to expand lending and may induce banks to drive up returns by taking greater risks.

Does the problem lie in weak business models or structural features of the systems in which banks operate? Both are important. While business models underlie profitability problems in some institutions, consistently low returns across banks in some countries suggest that structural forces are also at work. This can be seen most clearly among domestic banks, where returns are most constrained by the characteristics of the home market. Almost three-quarters of these banks in our sample, by assets, had weak returns on equity in 2016, compared with less than 40 percent for internationally focused peers.

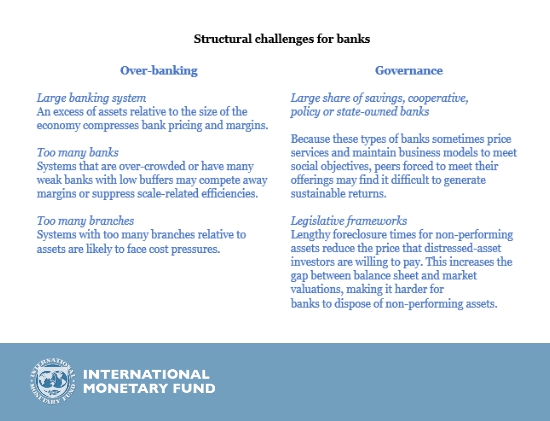

The IMF’s April 2017 Global Financial Stability Report discusses these structural challenges. One of them is over-banking. There is no common definition of this, but here the term refers to a set of structural factors that affects the profitability of banks across the system. The causes of over-banking can vary from country to country, and no single aspect clearly explains profitability concerns across a range of countries, but three important characteristics are listed below. Another important structural challenge is a large proportion of savings, cooperative, policy banks (such as development banks), and state-owned institutions, which can reduce the profitability of other banks in the system. Furthermore, problems in resolving non-performing loans mean that these assets continue to act as a drag on profitability. One example is lengthy foreclosure times that delay the disposal of non-performing assets.

A number of countries are addressing these structural issues . Banks in Denmark, the Netherlands and Spain have sharply cut branches. Banks in Spain underwent a substantial consolidation in 2009-12, accompanied by reforms to strengthen governance. In Italy, banks have merged, and governance reforms for cooperative banks have been legislated. Measures have also been taken to amend legal frameworks and help banks address the burden of non-performing loans. Some German banks have also merged. But more progress needs to be made in banking systems with the biggest challenges.

In many cases, the responsibility to change lies with individual banks. While no single business model works for all, most need to continue restructuring their businesses for higher returns and investing in technology to increase efficiency. Supervisors have a role to play in assessing business-model sustainability, as they are increasingly doing, and should ensure that banks do not respond to profitability pressures by taking excessive risks.

In over-banked systems, authorities should continue to encourage consolidation among small and medium-sized banks and ensure that this goes hand-in-hand with governance reforms, where needed. Consolidation does not have to mean that large banks get bigger; rather, it can mean small or mid-sized banks combine forces to become stronger. In banking systems with significant asset quality challenges, consideration could be given to targeted asset quality reviews for banks that have not undergone such an exercise. Regulators should then resolve unviable institutions to remove excess capacity from banking systems. Further harmonizing national supervisory practices and legal frameworks across countries should also enhance banks’ effectiveness. Measures are also needed to fully resolve the burden of non-performing assets; supervisors should ensurie that banks adopt ambitious, time-bound strategies for the disposal of bad assets. Finally, completing the regulatory reform agenda is vital to ensure that weaknesses are addressed and uncertainty is reduced.

Banks’ efforts to adapt their business models to changing regulatory and market challenges are necessary but may not be sufficient. Policy actions to improve system structures can foster conditions for banks to generate sufficient profitability with acceptable risk, and so become both safer and better able to support the economy.