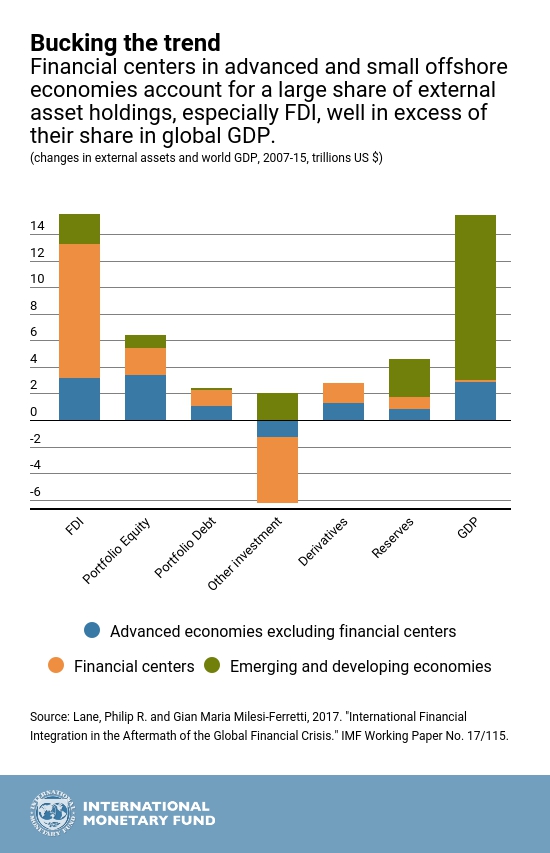

International financial flows have declined significantly after the crisis, and their composition has changed. As portfolio and other investment flows took a dip between 2007 and 2015, foreign direct investment (FDI) continued to surge. The increase is concentrated in financial centers, which now account for almost half of global FDI claims.

Our Chart of the Week, drawn from a recent paper, takes a deeper look at these new patterns in financial flows. It shows the large decline in flows to and from advanced economies, with a sizable scaling down of international activity by large European banks reflected in a reduction of other investment flows.

The paper also uncovers the disproportionate role played by financial centers after the crisis in facilitating trade in international assets and liabilities, especially FDI.

Financial centers include both advanced economies such as Ireland, Luxembourg, the Netherlands, Switzerland, and the United Kingdom—and small offshore centers such as Bermuda and the Cayman Islands.

As a group, these countries accounted for 7-8 percent of global GDP between 2007 and 2015. Yet the increase in their FDI claims and liabilities over the period has been dramatic—they currently account for about half of the world’s total FDI claims.

One often thinks of FDI as green investment with technology transfers to the receiving country. The concentration in financial centers, however, suggests that a big part of these flows may reflect financial transactions that have very little to do with the domestic economy.

In fact, two factors dominate the expansion of FDI in financial centers. The first is the role of special purpose entities. These are legal entities used to raise capital or hold assets and liabilities. They perform no production function and are typically part tax management strategies or regulatory arbitrage. In Luxembourg, for example, more than 90 percent of FDI claims are in special purpose entities.

The second factor behind the expansion is the increased tendency of multinational companies to move their domicile to a financial center. This could reflect decisions on the optimal ways to allocate assets to reduce tax and regulatory burdens.

Such decisions can generate practices such as inversions and re-domiciliation, whereby firms relocate legal quarters to lower-tax nations while retaining key operations in the higher-tax country of origin. Ireland is an example, where the stock of FDI claims increased by US$900 billion between 2007 and 2015—over three times the size of Irish GDP in 2015.

Overall, the growing role of purely financial asset re-allocation decisions by large corporations makes it harder to assess a country’s financial linkages and external vulnerabilities. This poses a big challenge for policymakers.