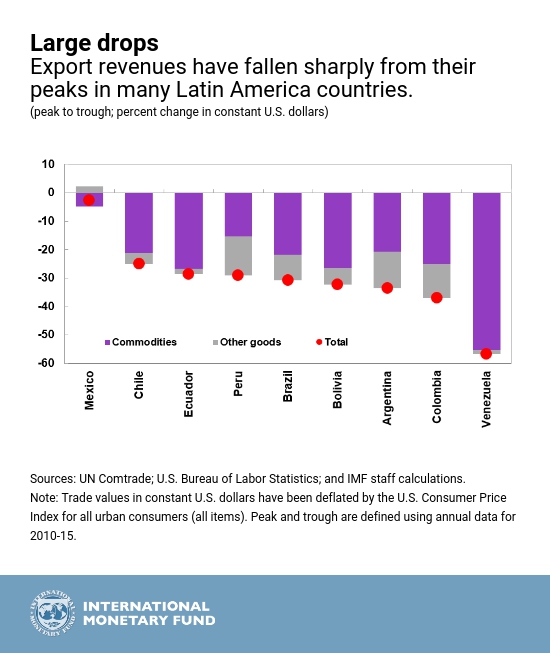

As world prices for Latin America’s key exports—oil, metal, and agricultural products—fell from their super-cycle peak in 2011 and demand from trading partners weakened, export revenues have dropped sharply. Across most of South America, export revenues have fallen by one-third, and by more than half in the case of Venezuela. The size of these shocks has been historic in some cases, ranking among the largest trade price busts faced by emerging economies around the world since 1960.

In Chapter 3 of the latest Regional Economic Outlook: Western Hemisphere, we argue that exchange rate flexibility has paid off by making the adjustment to these shocks less painful. However, most of the support from depreciations has come through import substitution—replacing foreign imports with domestic production—with the boost to exports playing a secondary role.

In a clear break from the procyclical policies of past decades, many Latin American countries stuck to their flexible exchange rate regimes and allowed their currencies to depreciate substantially. Given the size of the shock, the currencies of Brazil, Chile, Colombia, and Mexico lost about half their value against the US dollar.

Adjusting to external shocks: theory and practice

How are economies expected to respond following such a large loss in export prices and thus of export revenues? While buffers saved during booms may buy some time, sooner or later countries will need to adjust, with lower imports, higher exports, or some combination of both. In theory, this adjustment takes place through what economists refer to as income and expenditure-switching effects.

Income effects are a painful reflection of a grimmer reality: countries have been made poorer, in the sense that they have less purchasing power abroad. To tighten their belts in the face of reduced income, domestic demand and imports will drop.

Additionally, the movement of relative prices can trigger a series of expenditure-switching effects that re-shuffle production and spending across goods and countries. As foreign goods become less affordable, domestic consumers shift toward cheaper domestic alternatives, supporting local output. And as export products become cheaper in dollar terms, they are more affordable to foreign buyers. To the extent that exchange rate flexibility is a conduit for expenditure-switching effects, it can provide a key shock absorber for small open economies facing external shocks, by boosting exports and supporting domestic demand and output.

So how do countries tend to adjust in practice? Based on a recent study by Adler, Magud, and Werner covering terms of trade busts in 150 emerging economies since 1960, we show that income effects tend to dominate the process. That is, countries that suffer these types of shocks tend to decrease their imports and domestic demand sharply. In contrast, the boost from increased exports and domestic output typically play a secondary role.

The recent Latin American experience

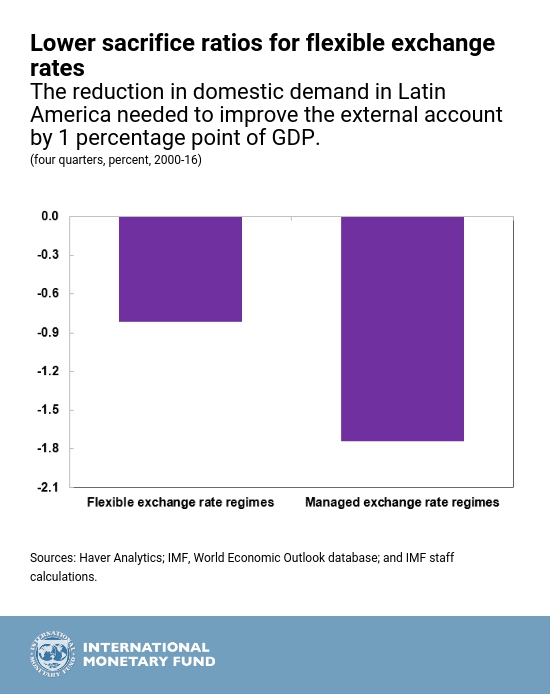

We show Latin America’s recent experience in terms of a sacrifice ratio of external adjustment: the extent to which domestic demand must compress for the trade balance to improve by 1 percentage point of GDP. Following the recent shock, the sacrifice ratio for the region’s economies with flexible exchange rate regimes has been about half the ratio observed in countries with managed exchange rates. Meanwhile, fixed exchange rates have become costlier—requiring more domestic demand compression to deliver the same adjustment—in part because of a reduction in the competitiveness of exports as a result of their currency becoming stronger against currencies of trading partners.

The presence of expenditure switching can be seen in the performance of exports and imports in countries with more flexible exchange rates. In these countries, non-commodity exports have responded positively to real depreciation following the terms-of-trade shock. However, this effect has been relatively weak: a 10 percent real depreciation increases real exports by only 2 percent in one year, while it lowers real imports by close to 7 percent.

Policy implications

Despite the secondary role played by exports at the aggregate level, a more granular analysis finds that manufacturing products tend to be more responsive to currency depreciations than commodities. Exchange rate flexibility can therefore support structural policies aimed at shifting Latin America’s resources to non-commodity sectors, since depreciations boost exports of manufactures more than for other goods. Supporting a dynamic manufacturing sector would also help spur diversification and raise the region’s growth potential.