Oil prices have been persistently low for well over a year and a half now, but as the April 2016 World Economic Outlook will document, the widely anticipated “shot in the arm” for the global economy has yet to materialize. We argue that, paradoxically, global benefits from low prices will likely appear only after prices have recovered somewhat, and advanced economies have made more progress surmounting the current low interest rate environment.

Since June 2014 oil prices have dropped about 65 percent in U.S. dollar terms (about $70) as growth has progressively slowed across a broad range of countries. Even taking into account the 20 percent dollar appreciation during this period (in nominal effective terms), the decline in oil prices in local currency has been on average over $60. This outcome has puzzled many observers including us at the Fund, who had believed that oil-price declines would be a net plus for the world economy, obviously hurting exporters but delivering more-than-offsetting gains to importers. The key assumption behind that belief is a specific difference in saving behavior between oil importers and oil exporters: consumers in oil importing regions such as Europe have a higher marginal propensity to consume out of income than those in exporters such as Saudi Arabia.

World equity markets have clearly not subscribed to this theory. Over the past six months or more, equity markets have tended to fall when oil prices fall—not what we would expect if lower oil prices help the world economy on balance. Indeed, since August 2015 the simple correlation between equity and oil prices has not only been positive (Chart 1), it has doubled in comparison to an earlier period starting in August 2014 (though not to an unprecedented level).

Past episodes of sharp changes in oil prices have tended to have visible countercyclical effects—for example, slower world growth after big increases. Is this time different? Several factors affect the relation between oil prices and growth, but we will argue that a big difference from previous episodes is that many advanced economies have nominal interest rates at or near zero.

Supply versus demand

One obvious problem in predicting the effects of oil-price movements is that a fall in the world price can result either from an increase in global supply or a decrease in global demand. But in the latter case, we would expect to see exactly the same pattern as in recent quarters—falling prices accompanied by slowing global growth, with lower oil prices cushioning, but likely not reversing, the growth slowdown.

Slowing demand is no doubt part of the story, but the evidence suggests that increased supply is at least as important. More generally, oil supply has been strong owing to record high output from members of the Organization of the Petroleum Exporting Countries (OPEC) including, now, exports from Iran, as well as from some non-OPEC countries. In addition, the U.S. supply of shale oil initially proved surprisingly resilient in the face of lower prices. Chart 2 shows how OPEC output has recently continued to grow as prices have fallen, unlike in some previous cycles.

Moreover, even in the United States, a net oil importer where demand has been fairly strong, cheap oil seems not to have given a substantial fillip to growth. Econometric and other studies suggest that only part of the recent decline in oil is due to slowing demand—somewhere between a half and a third—with the balance accounted for by increasing supply.

So there remains a puzzle: where in the world can the positive effects of lower oil prices be seen?

To address this question, the forthcoming April 2016 World Economic Outlook compares 2015 domestic demand growth in oil importers and oil exporters to what we expected in April 2015—after the first substantial decline in oil prices. The lion’s share of the downward revision for global demand comes from oil exporters—despite their relatively small share of global GDP (about 12 percent). But domestic demand in oil importers was also no better than we had forecast, despite a fall in oil prices that was bigger than anticipated.

Understanding why the naked eye cannot detect positive spending effects requires a closer look at the composition of demand in oil exporters and importers.

Domestic demand in oil exporters

In 2015, domestic demand in oil exporters was indeed much weaker than we had forecast a year before. This negative surprise reflected both weaker consumption and especially weaker investment. Rich oil exporters can draw on their reserves or sovereign wealth funds, and most of them have, but they have also been cutting government spending sharply. Poorer countries, of course, have much lower borrowing capacity, and risk crises if foreign debt levels get too high. Most have sharply lower current account surpluses or higher deficits, and their sovereign spreads have risen. In these countries domestic spending can fall sharply, in a nonlinear fashion—sometimes through the impact of large exchange rate depreciations that make imported goods more expensive. Public investment has fallen especially fast—most capital goods are imported, and when fiscal adjustment is needed, capital spending is typically the first item to be cut. And of course, factors unrelated to oil prices have also being weighing on economic activity in a number of oil exporters—ranging from domestic strife in Iraq, Libya, and Yemen to sanctions in Russia.

Of course, low oil prices make exploration and extraction activities less profitable in the private sector, leading to lower capital expenditures there as well. According to Rystad Energy, the fall in global capital expenditure in the oil and gas sector amounted to about $215 billion between 2014 and 2015—about 1.2 percent of global fixed capital formation (or just below 0.3 percent of global GDP). Even some oil importers have been hit hard, notably the United States, which accounts for a significant part of the global drop in energy-related investment.

Domestic demand in oil importers

Advanced oil importing economies have indeed seen some positive effects on consumption—for instance, in the euro area—but the impact has been somewhat less than anticipated. And investment growth has fallen short of expectations—also reflecting the unexpectedly large decline in U.S. energy-related investment mentioned above. The situation for oil importers in the emerging and developing world is varied. These countries typically have more limited pass-through from international to domestic fuel prices compared with advanced economies; some have reduced fuel subsidies. True, governments’ improved fiscal positions should eventually result in lower taxes or increased public spending, but the process could take time and is subject to various frictions and leakages. Overall, domestic demand growth for these oil importers was broadly in line with expectations—despite difficult macroeconomic conditions in a few countries that are exporters of other commodities.

Surprising macroeconomics at the zero interest-rate bound

There is another factor potentially impeding a pickup of demand in oil importers.

Compared with previous price cycles, falling oil prices this time coincide with a period of slow economic growth—so slow that the major central banks have little or no capacity to lower their monetary policy interest rates further to support growth and combat deflationary pressures.

Why does this matter? In the 1970s and 1980s, a large economics literature, summarized by Michael Bruno and Jeffrey Sachs more than three decades ago, showed how oil-supply-driven price increases lead to stagflation—a combination of higher inflation and slower growth. Stagflation is a direct result of higher costs for producers who use energy, costs that lead them to reduce output, shed labor, and raise prices to cover higher costs.

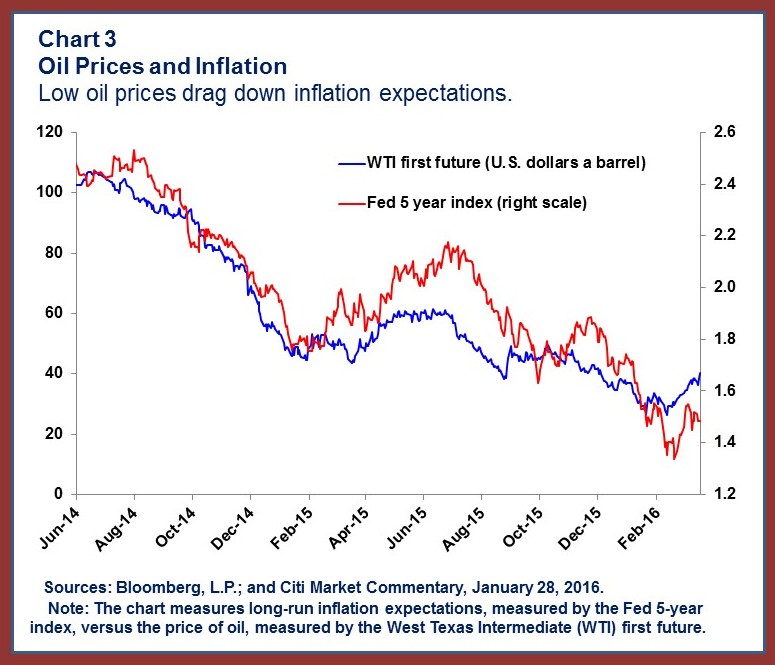

Even though oil is a less important production input than it was three decades ago, that reasoning should work in reverse when oil prices fall, leading to lower production costs, more hiring, and reduced inflation. But this channel causes a problem when central banks cannot lower interest rates. Because the policy interest rate cannot fall further, the decline in inflation (actual and expected) owing to lower production costs raises the real rate of interest, compressing demand and very possibly stifling any increase in output and employment. Indeed, those aggregates may both actually fall. Something like this may be going on at the present time in some economies. Chart 3 is suggestive of a depressing effect of low expected oil prices on expected inflation: it shows the strong recent direct relationship between U.S. oil futures prices and a market-based measure of long-term inflation expectations.

Being near the zero bound also can imply a “perverse” response to higher oil prices. When central banks are battling deflation pressures, they are unlikely to raise policy interest rates aggressively to counter an uptick in inflation. As a result, oil price increases, symmetrically, can be expansionary by lowering the real interest rate.

Of course, it would be wrong to conclude that central banks can enhance the benefits of current low oil prices by raising their policy interest rates. On the contrary, all else equal, that action would harm growth by raising real interest rates. Our claim is simply that when an oil importer’s macroeconomic conditions warrant a very low central bank interest rate, a fall in oil prices could move the real interest rate in a way that runs counter to the positive income effect.

The way forward

Persistently low oil prices complicate the conduct of monetary policy, risking further inroads by unanchored inflation expectations. What is more, the current episode of historically low oil prices could ignite a variety of dislocations including corporate and sovereign defaults, dislocations that can feed back into already jittery financial markets. The possibility of such negative feedback loops makes demand support by the global community—along with a range of country-specific structural and financial-sector reforms—all the more urgent.