Global financial markets traditionally take their cue from the United States. Unexpected Fed rate hikes have unsettled global markets in the past. The entire global financial system threw a tantrum when then Fed Chairman Ben Bernanke merely suggested in May 2013 that the end to bond-buying and other policies could soon begin. However for the past year, the gears of global markets seem to have been thrown into reverse — it is German government bonds, known as Bunds, rather than U.S. bonds, known as Treasuries, that appear to be driving prices in global bond markets. This role reversal could add a new layer of complexity to investor calculations as they prepare for the beginning of Fed interest rate hikes, which are expected later in 2015. Also, as developments in Greece lead to rises and falls in Bund and Treasury yields, this is a trend worth keeping an eye on.

Our latest Global Financial Stability Report highlighted that monetary developments in the euro area have had a particularly strong effect on long-term U.S. interest rates. At the Jackson Hole conference of central bankers in August 2014, Mario Draghi, head of the European Central Bank, said he would consider additional unconventional monetary policies to jump start the anemic euro area economy. Shortly after Jackson Hole, the European Central Bank followed through by introducing negative deposit rates and quantitative easing through large-scale asset purchases. This proved a turning point in the relationship between Bunds and Treasuries.

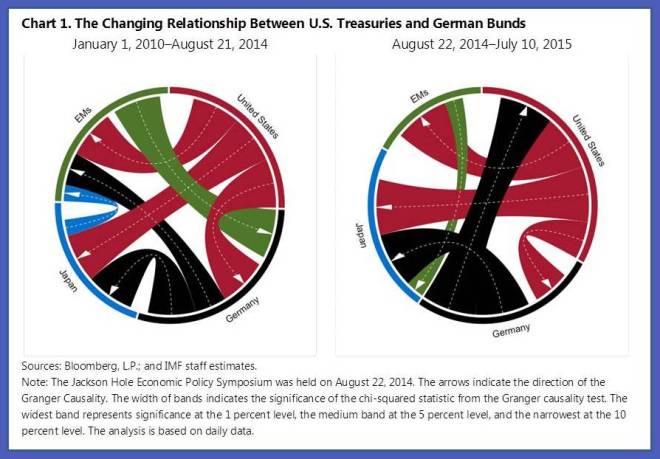

Using a statistical approach known as Granger causality analysis, we show that before August 2014, changes in the 10-year Treasury rate were more likely to precede (Granger cause) changes in the 10-year Bund rate. After this date, the reverse was true - changes in Bund yields were more likely to precede (Granger cause) changes in Treasury yields. Sure enough, as 10-year Bund yields declined 50 basis points by the end of 2014, 10-year U.S. Treasury yields declined by a similar amount (Chart 1).

Further evidence came on May 7, 2015, when 10-year Bund yields jumped from 0.59% to 0.78% (the highest in five months), before ending the daily session essentially unchanged. The Bund change triggered an equivalent response among Treasuries. Investors were quick to compare this to the Treasury “flash rally” of October 15, when the market experienced a similar sudden fall then rise. In the first days of June, another spike in 10-year Bund yields from 50 basis points to 1% dragged Treasury yields in their wake from 2.12% to nearly 2.50%. Both German and U.S. long-term interest rates have continued to move together in recent weeks, as developments in Greece lead to rises and falls in Bund and Treasury yields.

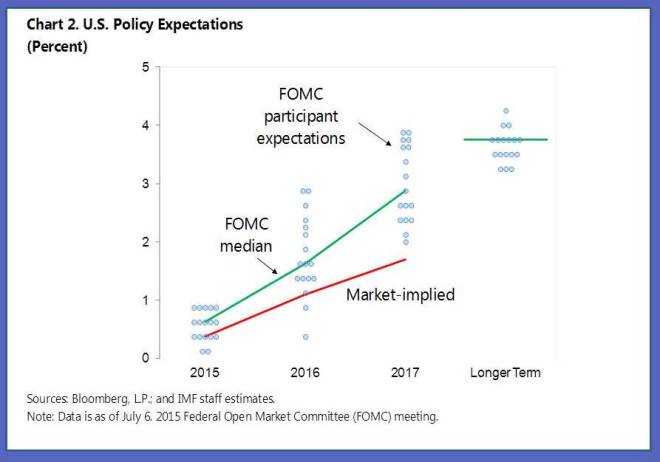

Our analysis back in October showed that there is some dissonance between market expectations on the timing and pacing of rate hikes and the Fed’s own projections. The market expects the pace to be relatively moderate and for the terminal Fed funds rate to be relatively low (Chart 2). This largely remains true even after the “Bund Bedlam” helped drive 10-year Treasury rates over 60 bps higher between April and June. As a result, the U.S. Treasury market may be setting itself up for a volatile period when the hard reality of the Fed’s intent to raise short-term interest rates inevitably confronts pressure on U.S. long-term rates from Europe. Despite headwinds like a slow first quarter, the stronger dollar and uncertainty arising from Greece, Fed communications have made it clear that the United States continues to make progress towards conditions that justify raising interest rates.