Countries will start a new chapter in their development this year with the United Nation’s Sustainable Development Goals. Designed to replace the Millennium Development Goals, these new goals will broaden the vision of development to embrace economic, social, and environmental issues. To achieve these goals, two elements are critical: money and the right policies to use the money. The IMF, along with many others in the global community, will partner with countries to bring these two elements together.

New goals, new world

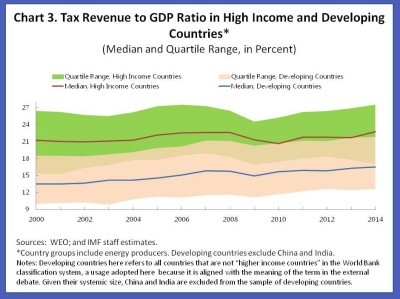

Countries are pursuing development goals in a new environment, as the world has become increasingly interconnected since the early 2000s. Global trade flows have increased steadily in the past two decades (Chart 1).

Many frontier economies are rapidly integrating with global financial markets. In 2014, for instance, Côte d’Ivoire, Ghana, Kenya, Senegal, Vietnam and Zambia issued government bonds totaling about US$7 billion. At the same time official development assistance has lost its top rank as the main source of capital flows to developing countries, dropping from 1.6 percent of developing countries’ collective GDP in 1990 to 0.7 percent of GDP in 2012 (Chart 2).

This increased integration has made developing countries more exposed to economic highs and lows from outside their borders— economists call them shocks— such as swings in global commodity prices, capital flows, and changes in exchange rates, to name a few.

Mobilize domestic revenues

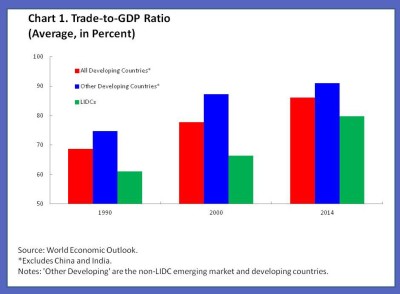

To fund development needs and to build resilience against shocks, many developing countries need both higher revenues and better managed tax collection and administration. Our engagement with countries shows that domestic policies can yield results (Chart 3).

For example, Peru has increased its domestic tax ratio from 6 to 13 percent of GDP over the 1990s, and stabilized it at about 17 percent since 2010; many others—for example, Tanzania and Vietnam—have made important strides as well.

Also, there is tremendous scope for strengthening domestic resources while addressing environmental concerns through energy price reform and carbon pricing, for example.

The IMF is helping countries strengthen their capacity to raise money at the national level and reform energy taxation and subsidies, among others.

Major advanced and emerging market economies can also help through collective action. These include: fulfilling foreign aid commitments to support the most vulnerable, enhancing international tax cooperation, reviving the global trade liberalization agenda, and agreeing national targets for reducing CO2 emissions at the climate change summit in Paris in December 2015.

Resilient economies is the goal

Money alone isn’t enough— countries need policies to translate and implement the sustainable development goals for their particular circumstances. They will need the right mix of policies to maintain an attractive environment for investment to thrive and make effective use of available resources on priority areas, such as health and education. In particular, good policies can help countries recover and rebound even through the worst shocks from outside their borders.

This covers measures that raise the contribution from their own resources to fund their goals. And measures to ensure that countries put to good use their funds, whether borrowed or from taxes, to address infrastructure gaps and promote inclusion. This will help create growth that is strong, sustained, and broadly shared, with debt levels that remain sustainable. These are all important components of a successful development strategy—and at the core of the IMF’s work with countries.

Countries are in the driver’s seat when it comes to their development goals. Their more advanced economy partners also need to do their part, adopting measures to foster stable global economic and financial conditions. And international institutions are akin to developing countries’ pit crews: a coterie of technical experts and advisors who work together with the driver to keep the show on the road.

The IMF is working with developing countries to strengthen their economies’ resilience in a more connected world. We are exploring options to refine our financing facilities to boost access to IMF concessional resources for the poorest and most vulnerable countries. And we are exploring ways to provide stronger safety nets for countries that have access to foreign capital markets, which also exposes them to capital flow shocks. These reforms will aim to enable developing countries to be better prepared to handle economic shocks while they pursue their development.

As we embark on the road towards Addis Ababa and beyond, all of us in the international community must step up our engagement to help ensure the Sustainable Development Goals become a reality.