Most economists would agree that institutions in general are incredibly important in helping to shape countries’ overall economic and fiscal outcomes. But which institutions really matter, and to what extent, is less clear.

A team of staff at the IMF recently completed a study, along with detailed country evaluations, that explores the G-20 countries’ efforts to strengthen their budget institutions in the wake of the global financial crisis, and evaluates their impact on fiscal policy. We ask whether strong budget institutions helped these countries to cope with the substantial fiscal consolidation needs that arose after the Great Recession. The evidence suggests that these institutions have indeed been important.

Budget institutions matter

In the study we identify 12 institutions (see figure1) that are commonly viewed as important for the effectiveness of fiscal policy. To be clear, the term “institution” is used in a broad sense—it encompasses processes, procedures, systems, legal frameworks, and organizational entities which contribute to the budget process.

The institutions are separated into three groups: those that help identify the fiscal challenges a country faces, those that help develop appropriate adjustment plans, and finally those that support implementation of any adjustment plan approved by government.

For example, the fiscal reporting system can be seen as one of the important institutions for identifying the fiscal difficulties a country may face. If fiscal reports do not cover large parts of the public sector, are not timely, or there are few assurances of the integrity of the data, the fiscal reporting institution is assessed as weak. In this fashion we identified for all 12 institutions criteria that helped us to assess the relative strength of the institutions.

Evidence points to effectiveness of institutions

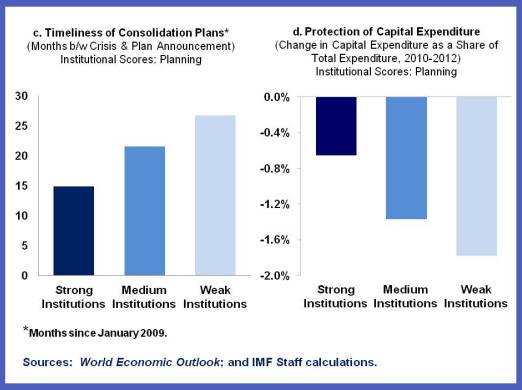

The 12 institutions were then tested individually, together in the groups mentioned above, or altogether, against a number of indicators of fiscal performance. The graphs below show the most interesting findings. Countries with stronger institutions overall seem to recognize the need for fiscal adjustment, in line with the IMF’s assessment of the required consolidation effort (graph a), while countries with strong implementation institutions carry out much more of their announced adjustment plans than countries with weak institutions (graph b). It is also remarkable that countries with strong budgetary planning institutions tend to develop and announce their adjustment strategies more rapidly (graph c), and protect capital expenditure (graph d)—important for long-term growth—more successfully during consolidation.

So are there any caveats to this analysis? Yes, of course. The main ones are that the findings are based on a relatively small group of countries and that the period of investigation was quite short (2010–13). As always, proving causality is problematic in institutional analysis. The analysis also does not identify whether the fiscal policy effort of countries during the period was appropriate for the stage of the economic cycle. Further analysis and confirmation of the results will be necessary in the coming years.

Reform effort uneven

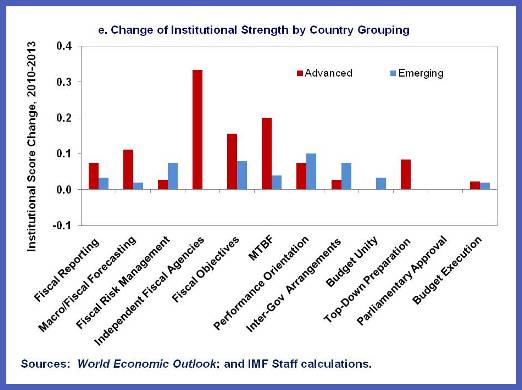

It is interesting to note, however, that countries themselves seem very much convinced that institutions do matter. G-20 countries are all pursuing reforms, especially those under fiscal pressure in the wake of the crisis. Yet reforms have been uneven across country groupings and across institutions. Advanced G-20 economies, especially those in Europe, and those with specific consolidation plans seemed to have been the strongest reformers. Emerging market economies did relatively well on improvements in fiscal risk management and performance orientation, but, overall, there has been a widening of the gap in institutional strength between advanced and emerging G-20 countries (graph e).

Looking at the type of reforms that have been popular it is clear that independent fiscal agencies, fiscal objectives and rules, and medium-term budgetary framework have been the flavor du jour of budget reforms since the crisis. These reforms have been important in making economic forecasts less biased, fiscal frameworks more credible, and fiscal policy more sustainable. They were also an essential part of making fiscal policy coordination possible in the eurozone.

Reforms requiring relatively more administrative or political effort have seen less progress, both in advanced and emerging economies. Changes in fiscal reporting and fiscal risk management have been relatively limited, which still makes it difficult for policy makers and politicians to fully understand the fiscal challenges they are facing. Also changes to intergovernmental financial arrangements—to better coordinate fiscal policy between layers of government—have seen few improvements. Extra-budgetary funds and other earmarks, summarized in the “budget unity” institution, still limit budget flexibility in many countries.

The country evaluations set out priorities for further institutional reform for each of the G-20 countries but, overall, during the past three years, these countries have made progress in strengthening their budget institutions and these institutions have played a critical role in helping them adjust to new fiscal realities.

So bottom line—institutions matter—and G-20 countries would do well to continue to reinforce their institutional architecture for fiscal policymaking.