Large banks were at the center of the recent financial crisis. The public dismay at costly but necessary bailouts of “too-big-to-fail” banks has triggered an active debate on the optimal size and range of activities of banks.

But this debate remains inconclusive, in part because the economics of an “optimal” bank size is far from clear. Our recent study tries to fill this gap by summarizing what we know about large banks using data for a large cross-section of banking firms in 52 countries.

We find that while large banks are riskier, and create most of the systemic risk in the financial system, it is difficult to determine an “optimal” bank size. In this setting, we find that the best policy option may not be outright restrictions on bank size, but capital—requiring large banks to hold more capital—and better bank resolution and governance.

Large banks increase systemic, not individual bank risk

Large banks have significantly grown in size, and become more involved in market-based activities since the late 1990s. Figure 1 shows how the balance sheet size of the world’s largest banks increased two to four-fold in the 10 years prior to the crisis. Figure 2 illustrates how banks shifted from traditional lending towards market-oriented activities.

Source: Bankscope, World Bank Financial Development and Structure Database, and authors’ calculations. The loan-to-asset and non-interest income ratios are computed as the average across the four largest banks in each country.

Source: Bankscope, World Bank Financial Development and Structure Database, and authors’ calculations. The loan-to-asset and non-interest income ratios are computed as the average across the four largest banks in each country.

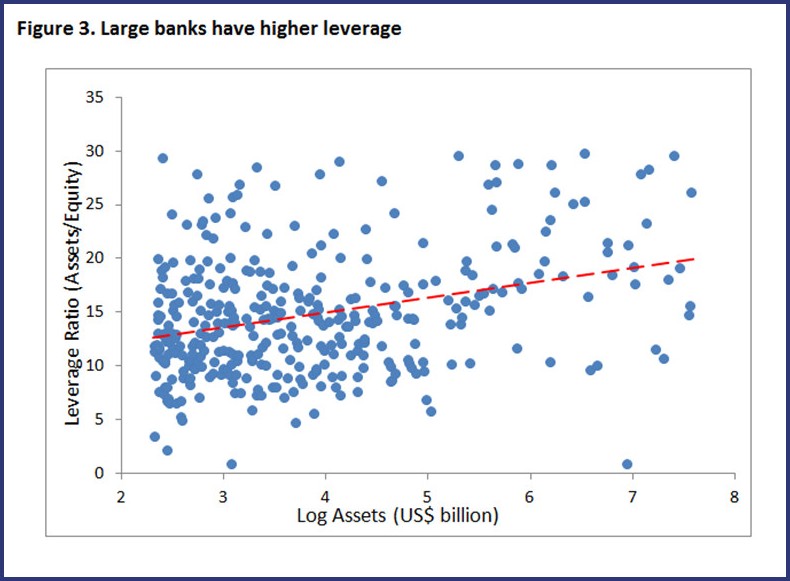

Also, large banks appear to have a distinct, seemingly risky business model. They tend to simultaneously have lower capital (Figure 3), less stable funding (Figure 4), more market-based activities (Figure 5), and be more organizationally complex (Figure 6), than smaller banks.

Source: Bankscope and authors’ calculations. Data for 2011. Assets are in log billions of US dollars (log assets = 2 corresponds to US$7.4 billion, log assets = 5 to US$148 billion). Number of subsidiaries is in log (1+Number of subs).

In addition, our study confirms that large banks create most of systemic risk in today’s financial system. We measure systemic risk as expected bank capital shortfall in a financial crisis, that is, the bank’s contribution to how deep a crisis would be. Large banks create especially high systemic risk when they have insufficient capital or unstable funding. And, large banks create high systemic risk, but, interestingly, are not individually riskier, when they engage more in market-based activities, or are organizationally complex.

Too-big-to-fail and empire building

What drives the size and the business model of large banks? Our study suggests the following:

• Implicit too-big-to-fail subsidies (see the IMF's recent Global Financial Stability Report). The perception that the creditors of large banks will be bailed out during bank distress, the so-called “moral hazard” problem, lowers the cost of debt for large banks. This predisposes large banks to use leverage and unstable funding, and to engage in risky market-based activities.

• Possible empire building. A relatively high disagreement among analyst earnings forecasts for large banks suggests that these banks are complex, non-transparent, and therefore difficult for outsiders (or even insiders) to understand and control. This entrenches managers and enables them to pursue empire building strategies, leading to ever larger banks.

• Economies of scale. While a good explanation for the size of large banks, recent studies suggest that they are modest. The value of the economies derived from the presence of large banks is $16-45 billion per year (for U.S. banking system). That is 0.2% of the $20 trillion U.S. banking system size, and small in comparison to the estimated US$6-12 trillion cost of the recent financial crisis.

Optimal bank size inconclusive

The evidence that large banks respond to too-big-to-fail and empire building incentives, and in process create systemic risk suggests that banks might become “too large” from a social welfare perspective. But there is an important caveat. We know too little about the value that large banks bring to their customers (e.g., large global corporations). The potential for economies of scale in large banks cannot be dismissed. As a result, we cannot draw conclusions as to the socially optimal bank size. And it also implies that outright restrictions on bank size or activities may be imprecise and hence costly.

Traditional bank regulation insufficient for large banks

Our findings have useful implications for designing policy for large banks:

• We need systemic risk-based regulation of large banks. The usual micro-prudential bank regulation may be insufficient. First, it may not fully reflect the systemic ramifications of large banks’ risk-taking, since the same capital or funding deficiencies create more systemic risk when they occur in large banks. Second, it may neglect the distortions associated with large banks’ involvement in market-based activities and organizational complexity, since they increase systemic but not individual bank risk.

• Such regulation may take form of capital surcharges on large banks, in line with Basel III. Our analysis allows quantifying the effectiveness of such surcharges. For example, for a large bank with about $1 trillion in assets, an increase in the capital ratio by 2.5 percentage points (similar to the systemic surcharge in Basel III) reduces its systemic risk by a quarter. And if that increase in capital is combined with measures to bring the banks’ involvement in market-based activities, funding structure, and organizational complexity in line with those of medium-sized banks (should this be possible), the systemic risk is reduced by another quarter.

• There is a need for better bank resolution and governance. Better resolution would reduce “too-big-to-fail” distortions. Corporate governance policies should target organizational complexity, deal with high-powered incentives that encourage risk-taking in large banks, and include measures to strengthen risk controls