Recent talk about deflation in the euro area has evoked two kinds of reactions. On one side are those who worry about the associated prospect of prolonged recession. On the other are those who see the risk as overblown. This blog and the video below sift through both sides of the debate to argue the following:

- Although inflation—headline and core—has fallen and stayed well below the ECB’s 2% price stability mandate, so far there is no sign of classic deflation, i.e., of widespread, self-feeding, price declines.

- But even ultra low inflation—let us call it “lowflation”—can be problematic for the euro area as a whole and for financially stressed countries, where it implies higher real debt stocks and real interest rates, less relative price adjustment, and greater unemployment.

- Along with Japan’s experience, which saw deflation worm itself into the system, this argues for a more pre-emptive approach by the ECB.

I. Is there deflation?

Mario Draghi has described deflation in the euro area as a situation where price level declines occur (1) across a significant number of countries; (2) across a significant number of goods; and (3) in a self-fulfilling way.

By this definition, the term "deflation" is arguably overstatement.

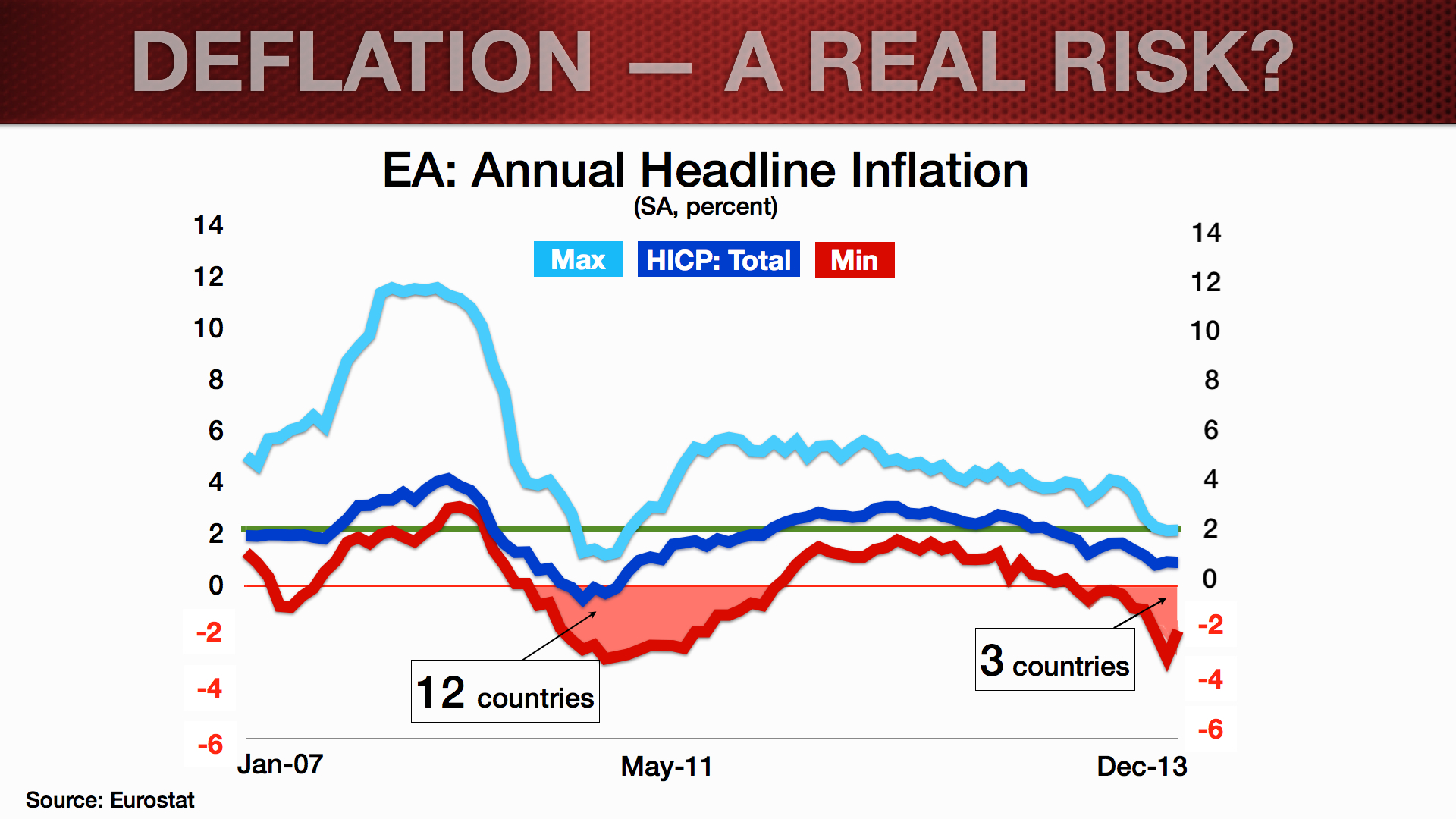

First, on geographical scope, recent price changes have been positive in all but 3 countries (versus 12 countries as recently as 2009).

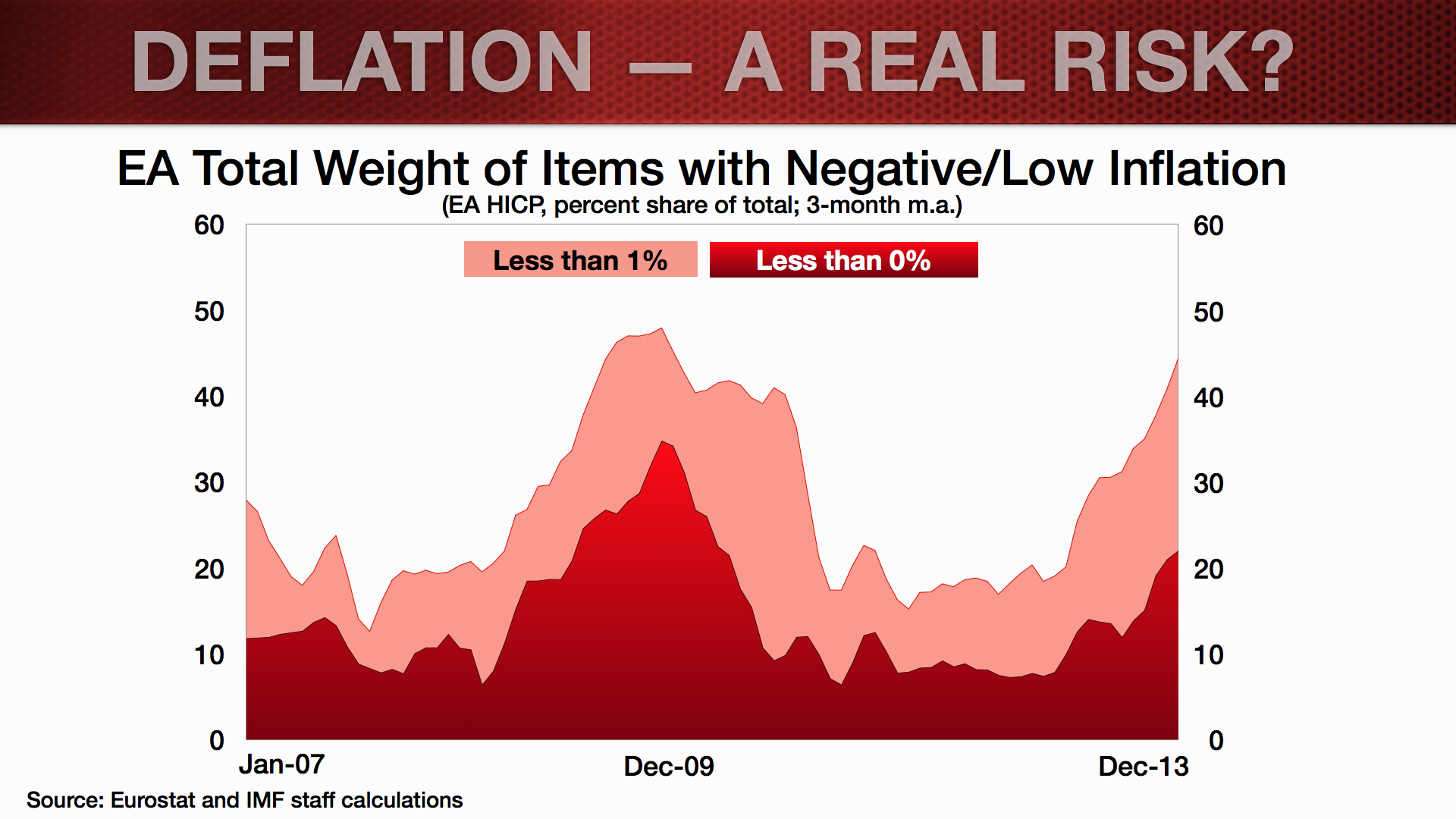

Second, regarding incidence across goods and services, outright price declines account for only a fifth of the HICP basket — not a high share and, again, no more than in 2009, when the event passed without deflationary consequence.

Third, is there is a "self-fulfilling" dynamic in the sense that expected future inflation is dragging down current inflation? Here the answer is less obvious. If by expected future inflation we mean longer term rates, then the answer is no: expected inflation 5-10 years out is flat and so could not possibly be the cause of falling current inflation. But if we consider 2-4 year ahead expected inflation, the horizon relevant for many spending decisions and wage negotiations, these are falling and could be affecting current inflation. That said, actual inflation stabilized in February at 0.8%.

II. But if it’s not “deflation”, what’s the problem?

In the current European context, even very low inflation can scupper the nascent recovery and pressure the most fragile countries.

Problem #1

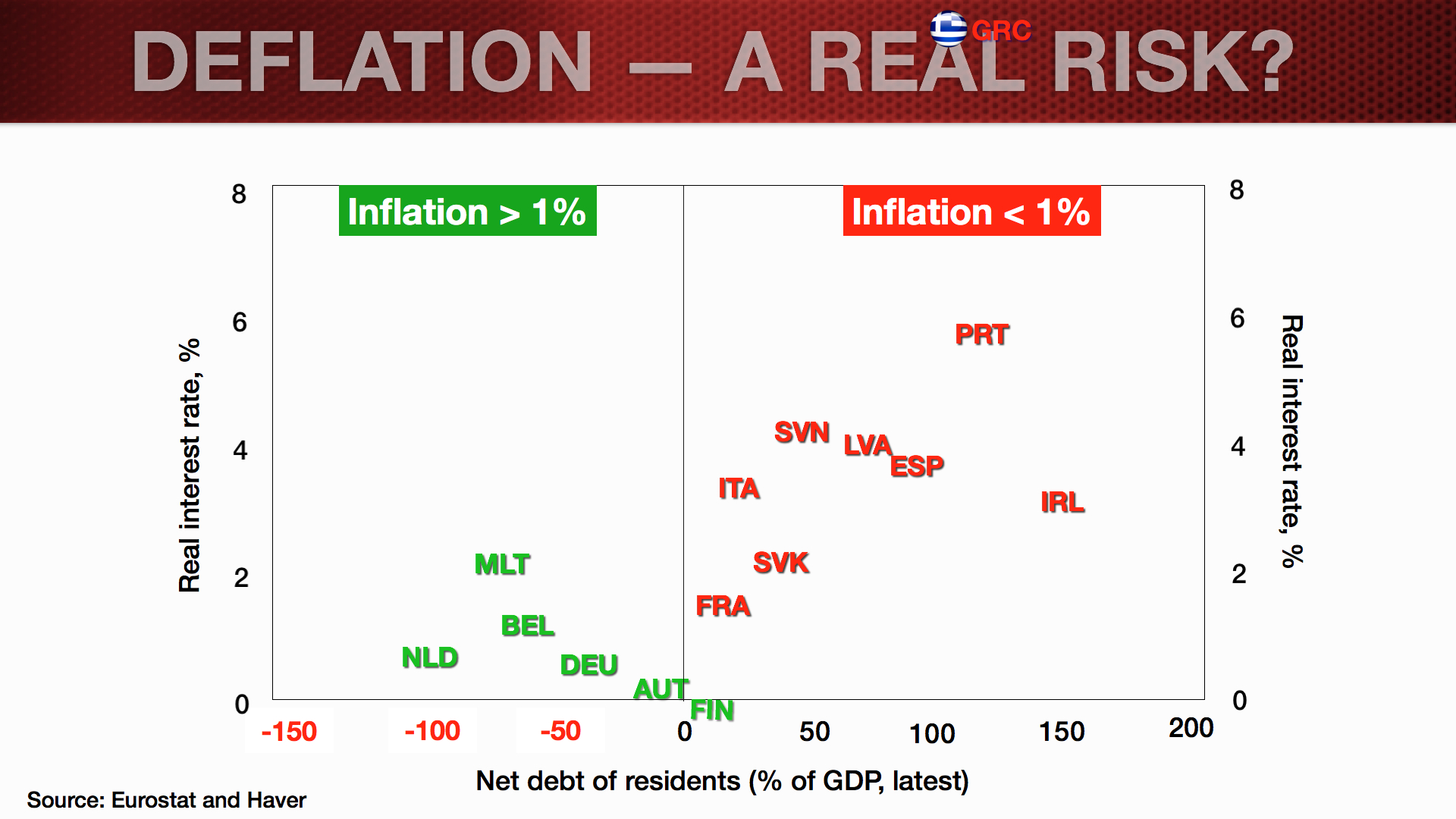

Both deflation and less-than-previously-expected inflation increase the real burden of existing debt and the real interest rate that borrowers pay. As it happens, the countries with deflation/low inflation, marked red in the chart below, also happen to be the ones with already higher debt burdens (private + public) and real rates, and include all the countries that have been under market pressure during the crisis.

Problem #2

While deflation/lower inflation in high debt countries is painful to them, at least it improves relative prices, and hence exports and current account sustainability. Unfortunately, when inflation turns low everywhere in the euro area, each unit of deflation/low inflation endured by indebted countries delivers less price adjustment relative to the surplus countries. Or put another way, each point of relative price adjustment must be bought at the cost of greater debt deflation.

Problem #3

When demand drops and nominal wages are sticky, the hit to unemployment is cushioned by any on-going inflation, which effectively lowers the real wages that firms pay. That cushion is now badly needed. In Spain, we see in the next chart that, after the crisis, the wage distribution slammed against the zero-barrier, with 30% of the distribution concentrated there. Given sticky nominal wages, near zero inflation in Spain is not helping to resolve the severe unemployment problem there.

III. What are the lessons from Japan’s experience?

There are at least two.

Lesson #1

One should not take too much comfort in the fact that long-term inflation expectations are positive (over 2% in the euro area). Long-term inflation expectations on the eve of three deflationary episodes in Japan were also reassuringly positive. But nearer-term expectations turned more pessimistic, feeding into spending and wage decisions and delivering actual deflation. Long-term expectations adjusted too little and too slowly to be a useful guide to monetary policy. The takeaway: not-so-long-term inflation expectations, which we saw are falling in the euro area, also need to be given due consideration.

Lesson #2

One needs to act forcefully before deflation sets in. As shown below, the Bank of Japan was relatively slow in lowering policy rates and ratcheting up base money. In the event, it had to resort to ever-increasing stimulus once deflation set in (shaded grey areas in the second chart). Two decades on, that effort is still ongoing.

IV. Conclusion

You can have too much of a good thing, including low inflation. Very low inflation may benefit important segments of the population, notably net savers. But in the current context of widespread indebtedness problems, it is working to the detriment of recovery in the euro area, especially in the more fragile countries, where it is thwarting efforts to reduce debt, regain competitiveness and tackle unemployment. The ECB must be sure that policies are equal to the tasks of reversing the downward drift in inflation and forestalling the risk of a slide into deflation. It should thus consider further cuts in the policy rate and, more importantly, look for ways to substantially increase its balance sheet, be it through targeted LTROs or quantitative easing (public and private asset purchases).

[youtube http://www.youtube.com/watch?v=ORSoJRSAzjo&w=560&h=315]