(Versions in عربي, 中文, Español, Français, Русский, 日本語)

The slow global recovery is making fiscal adjustment more difficult around the world, but this doesn’t mean that little has been accomplished.

In fact, significant progress in many countries has been made during the past two years in strengthening their fiscal accounts after the 2008–09 deterioration. The IMF's latest Fiscal Monitor takes stock of this progress.

Deficits are lower, and in many cases debt is too

Let me first say something about advanced economies, which is where the most urgent fiscal problems exist.

Most advanced economies have made good progress lowering their fiscal deficits (the imbalance between spending and revenues). Deficits, adjusted for the economic cycle, fell by about ¾ of a percentage point of GDP in 2011 and 2012, and are projected to do so by about 1 percentage point of GDP in 2013.

But, as I discuss at a bit more length in our Fiscal Monitor video, deficits are not declining enough to stop the rise in public debt: countries borrow less than in the past but they still borrow quite a lot and overall their debt is increasing, including in relation to GDP.

This is partly because GDP growth is low. But even here there is some progress, because even though debt ratios are still rising, they are doing so at a slower pace than in the past.

These are averages, though, and they obscure a lot of important details. Let’s look more closely at what advanced economies are doing.

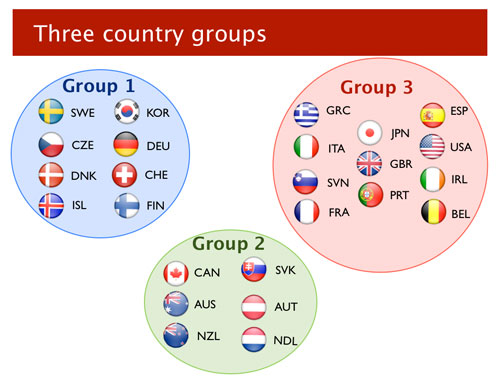

Broadly speaking, we can sort the advanced economies into three groups.

The first group includes those countries with declining or stable public–debt-to GDP-ratios.

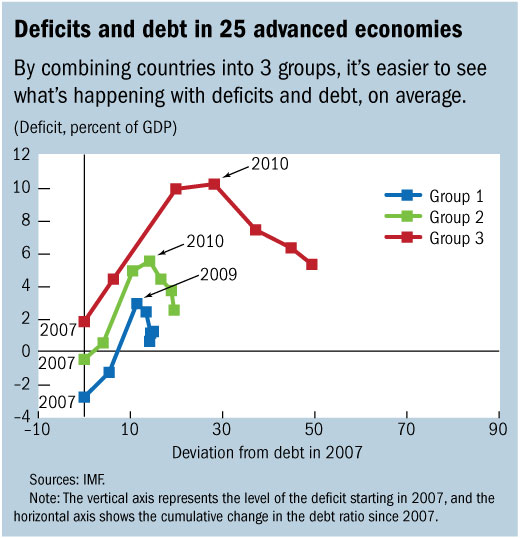

The chart below shows their average deficit and increase in the debt ratio over time. The vertical axis represents the level of the deficit starting in 2007 and the horizontal axis shows the cumulative change in the debt ratio since 2007.

For countries in the first group, represented by the blue line, debt and deficits initially increase. Subsequently, their deficits start to decline, but the debt ratio keeps rising. Finally, in the last stage the debt ratio starts to catch up with the deficit and begins falling, too.

The second group consists of countries where the debt ratio hasn’t started to fall yet, but is about to do so. Deficits in this group are falling, and the increase in the debt ratio is petering out, but they have not quite turned the corner on debt, which, however, remains relatively low (see the green line).

The third group consists of countries where the fiscal imbalances are larger. In most of these countries deficits have started declining, but debt is high, or still rising, or both (see the red line).

So where do we go from here?

Many countries, particularly among those in the third group, will have to proceed with fiscal adjustment for several years.

As we have underscored in the past, the necessary speed of adjustment will depend on the size of fiscal imbalances, the degree of market pressures, and the state of health of the overall economy.

In general, we continue to believe that a relatively gradual pace of fiscal adjustment is preferable, given the still persistent weakness of economic activity. In the United States, maintaining a gradual pace of adjustment will require avoiding the “fiscal cliff” of automatic deficit reduction, and timely action to raise the debt ceiling.

As to emerging economies, the Fiscal Monitor underscores that, on average, their fiscal deficits and debt are well below those of advanced economies. Most of these countries will pause their fiscal adjustment in 2012 and 2013: the average fiscal adjustment in these countries, which had been sizable in 2010 and 2011, will be almost zero this year and next year.

This is an appropriate response to the weaker global outlook, but there are several emerging economies that, over the medium term, will have to make significant efforts to reduce their still sizable deficits and debt. It is indeed significant that several emerging economies are still running very large primary deficits—so their revenues are not even sufficient to cover their non-interest expenditure—in spite of several years of historically strong growth.

So when the downside risks to global growth recede, these countries will need to begin making progress again in reducing their fiscal weaknesses.