(Version in Español)

Here in Washington D.C., Spring is showing its early signs, so we naturally feel a bit more upbeat. But spring comes in fits and starts—a day of sunshine, followed by cold rain, followed by sunshine again. So, we carry an umbrella on sunny days—but also have sunscreen ready. It's much the same for most of Latin America and the Caribbean, as we discuss in our Regional Economic Outlook for the Western Hemisphere. So, on a spring day, how do we see things?

Well, before explaining what I mean, let me start with a broad overview.

Most of Latin America stands out from much of the rest of the world—not for great economic performance, but for good performance in a subpar environment. Growth is generally solid, despite a slowdown late last year owing to policy tightening and global volatility. Under our baseline scenario, we expect regional growth to moderate to near 3¾ percent in 2012, down from 4½ percent last year (but modestly up from our January projections).

Some countries will continue to benefit from twin tailwinds of high commodity prices and easy international financing. But others will face weak demand from advanced country partners, or homegrown fiscal problems. And for all countries short-term risks (while receding) still tilt downwards—renewed European tensions or a large oil price shock could hit financial markets and global growth, triggering safe haven flows out of emerging markets, including Latin America.

The region is quite diverse, so let me focus today on the inflation targeting commodity exporters (Brazil, Chile, Colombia, Peru, and Uruguay), which represent close to 60 percent of the region’s total GDP. These countries have generally fared well, thanks to good economic policy management as well as favorable external conditions—the twin tailwinds. These tailwinds may persist for a while, unless large shocks appear. In fact, even modest-sized shocks would probably not disrupt capital flows into the region for too long.

With this group of economies mostly near or above full capacity, policies need to continue moving to neutral. The stimulus rightly deployed to combat the effects of the 2008–09 financial crisis has been only partially unwound. Indeed, overheating remains a risk—credit and import growth have slowed but are still strong. In particular, continued fiscal normalization is essential—not just to avoid driving an overheating cycle and reduce the burden on monetary policy, but to preserve credibility and make space for a response if downside risks materialize again. The authorities also need to keep in mind that favorable conditions will not last forever, so it will be important to manage the abundance well.

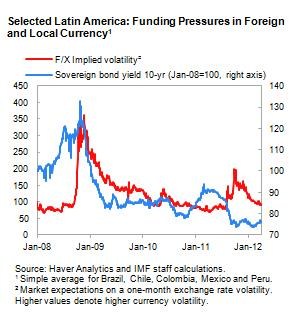

Meanwhile, monetary policy should remain nimble and continue to serve as a first line of defense in case of adverse global shocks. The Lehman and European crises have a common thread—the global propagation of liquidity shocks. We’ve seen the effects of these shocks on our shores—tightening in local markets, including shortages of dollars. While those effects have waned, policymakers need to be alert for droughts punctuating the rainfall, and stand ready to support liquidity in their markets in the short term, as needed.

In these ways, policymakers can carry both an umbrella and sunscreen. Now is not the time to rest easy; nor to try to fight risks that haven’t materialized yet. Instead, rebuilding resilience and flexibility will provide the best bet for continued good economic performance, until the skies clear for good and summer comes.

Let me conclude by noting that this edition of our Regional Economic Outlook features three analytical notes on: (i) how global financial shocks affect output in Latin America; (ii) the real spillovers from the region’s largest economies; and (iii) developments in the housing and mortgage market in the region. These will be discussed in forthcoming blogs.