Indiana Jones, the fictional character of the namesake movies, once said “It’s not the years, it’s the mileage.” This quote comes to mind as many advanced economies wrestle with pension reform and the best way to ensure both retirees and governments don’t go broke.

Our view, explained in a new study, is that the years do matter.

Our analysis shows that gradually raising retirement ages could help countries contain increases in pension spending and boost economic growth. Further cuts in pension benefits, or raising payroll contributions, are also options countries could consider, although many countries will find many advantages in raising retirement ages.

The challenge is to reform pension systems without hurting their ability to provide income security for the elderly and prevent old-age poverty.

Pension Reform and Fiscal Consolidation

Pressures from aging populations and increases in pensions—relative to wages— have pushed public spending in this area from 5 percent of GDP in 1970 to 8½ percent in 2010. Pension spending now accounts for about a fifth of government spending. Higher pension spending has helped alleviate old-age poverty in many countries, but has also put pressure on public finances.

The level of pension spending a country should aim for is ultimately a question of public preference. However, since many countries need to reduce government debts and budget deficits, most big-ticket public spending categories, including pensions, will need to be part of countries’ fiscal adjustment strategies. This is particularly important in countries where pension spending will continue to rise under current policies.

Outlook for Spending and Risks Ahead

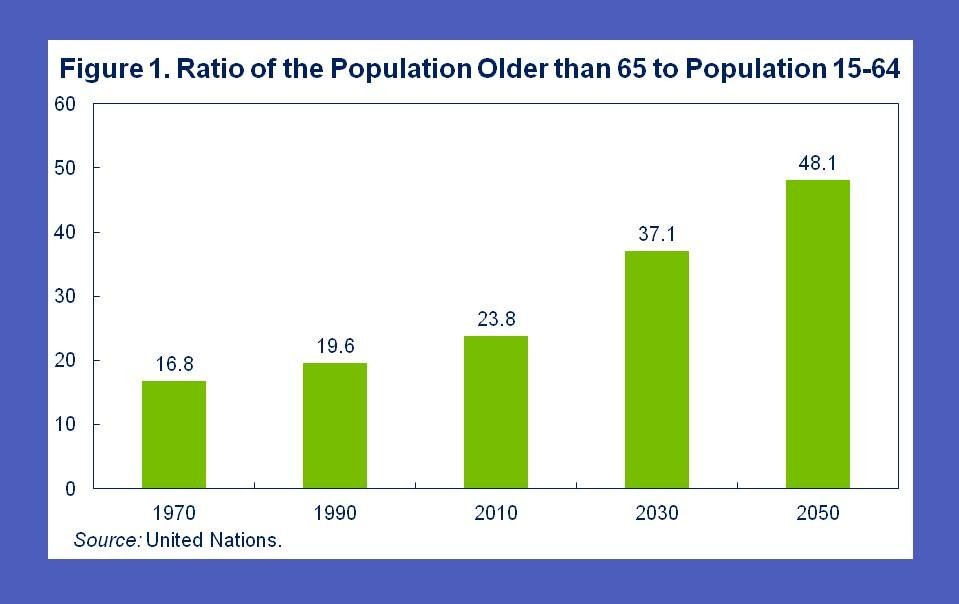

Pension systems, both public and private, are designed to give people access to the benefits of future production to support their consumption during retirement. This makes pensions vulnerable to demographics: in the future, there will be many more retirees consuming what fewer workers will produce (Figure 1).

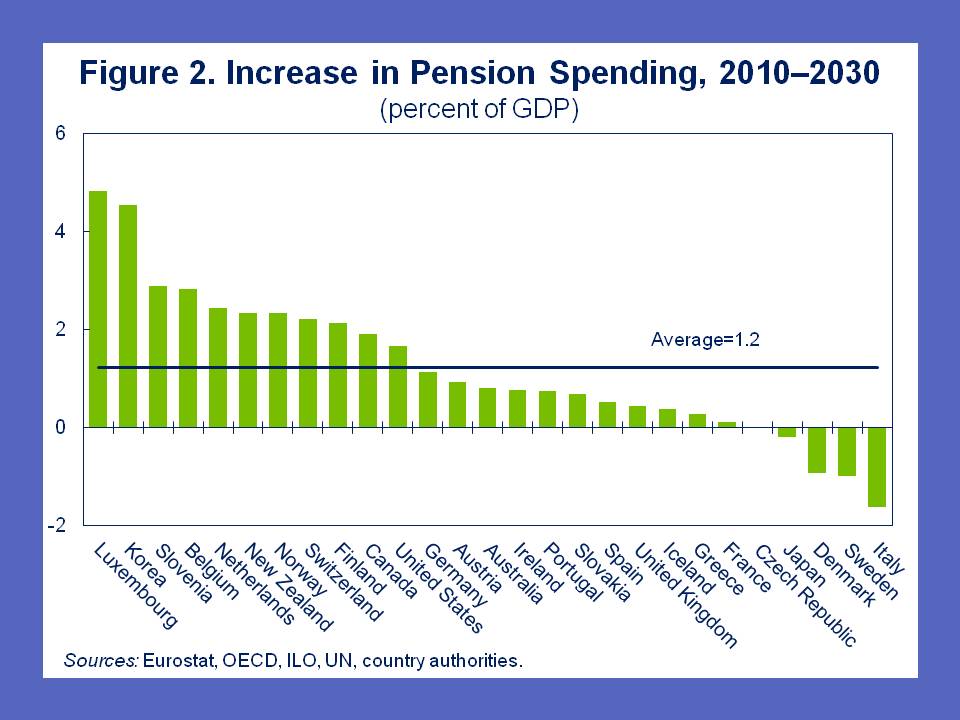

From a fiscal perspective, taming public spending will not be easy in light of population aging. Pension spending is expected to rise on average by 1 percentage point of GDP, and over 2 percentage point of GDP in over 9 countries (Figure 2).

There’s also a chance that spending increases could be even higher than depicted in the chart above. Life expectancy has consistently outstripped projections—this is certainly a good thing, but it has added to the fiscal costs of pensions. In addition, some countries’ official projections are based on optimistic assumptions about productivity growth compared to the recent past. Spending could also be higher than we project if there is popular resistance to implement reforms that have already enacted, once they start kicking in.

Fixing the problem

Pension reform is a politically sensitive issue and each country will need to find its own solution. As I mentioned earlier, the range of measures includes raising retirement ages, cutting pension benefits, and increasing revenues.

Among these options, gradually raising retirement ages would be an attractive option for many advanced economies:

- In countries where the tax burden is already high, further contribution hikes may jeopardize competitiveness and growth prospects. On the contrary, raising the retirement age can help boost GDP by increasing the number of years the average person spends working rather than in retirement.

- Raising retirement ages would help avoid even larger cuts in benefits than those already legislated, thus reducing the impact of reforms on elderly poverty.

- Gradual increases in retirement ages have already been legislated in many advanced economies. On average, these reforms are expected to increase the retirement age by about one year over 1990–2030. But this pales in comparison to the roughly five-year increase in life expectancy at retirement in this period. For these reasons, raising retirement ages may be easier for the public to understand than cutting pensions or increasing contributions.

- Over the long run, there is no reason why increasing the number of older workers would affect employment opportunities for younger generations—just like the large increase in the number of female workers has not resulted in fewer jobs for men over the last few decades.

Raising retirement ages by another 2½ years by 2030 —about 1½ months per year— would reduce pension spending in advanced economies by an average of 1 percentage point of GDP. Of course, this kind of reform would need to be accompanied by adequate disability pensions and social assistance programs to protect those who cannot extend their work lives. We also need to keep in mind that longevity might not be increasing as fast for lower-income groups than for the rest of the population.

As I mentioned, some countries could also consider reducing pensions where these benefits are high. However, benefit cuts for those close to the poverty line should be avoided. Others could consider raising payroll contributions where these rates are relative low. To minimize the impact on low income workers, measures such as raising the caps on contributions could be considered.

Let’s not forget that as serious as the pension problem is, health care spending looms as an even bigger challenge. This is why tackling both pensions and health spending should be key components of countries’ fiscal adjustment plans.

Advanced countries face difficult choices as they undertake fiscal adjustment. While pension reforms will certainly need to be part of the picture, we must keep in mind the vital role pensions play in reducing old-age poverty.

Pension issues are no less important in emerging economies, and will be the topic of a future blog.