Ahead of my arrival today in Mexico with the IMFs Managing Director Dominique Strauss-Kahn, I can’t help but reflect on how things have changed for the better in Mexico over the past decade in the sphere of economic policy. At the same time, I am struck by the importance of the task ahead for Mexico: grasping the opportunities offered by the changing global scene.

Strong frameworks

Mexico’s economic institutions have been very substantially strengthened. The balanced budget fiscal rule has supported fiscal discipline and a reduction in public debt. Moreover the structure of this debt has been radically improved—Mexico has created a deep domestic bond market and extended maturities. The introduction of inflation targeting has cemented the credibility of Banxico and fostered a reduction in inflation—that most unequal of taxes on the poorest—to low single digit levels. Meanwhile, the deep commitment to the flexible exchange regime has created an important safety valve for the economy.

Better outcomes

These investments paid dividends during the crisis. Yes the impact on Mexico of the deep shock in the U.S. was profound, with GDP falling by over 6 percent in 2009. But the country’s strong institutions provided a key anchor and most importantly, space for the authorities to take action to soften the blow of the downturn on the population.

Both fiscal and monetary policies were eased to support the economy. The exchange rate and other prices adjusted to maintain economic equilibrium. Recognizing the strength of the policy framework, the IMF invited Mexico to pioneer the new Flexible Credit Line which is designed to provide insurance against external shocks to countries with very strong economic policies, like Mexico. This successfully contributed to warding off tail risks during the crisis. And Mexico is now recovering well, with growth expected at 5 percent in 2010.

Global shift taking place

The financial crisis has marked what may be seen by future generations as a moment of profound transformation in the world economy. So-called emerging market countries are coming to the fore, both as sources of global growth going forward, but also by taking on an increasing role in global governance, including through representation at the IMF.

Latin America is a key part of this change, with fast growing economies such as Brazil, Chile and Peru providing important support to the global recovery, but also benefiting from increasing trade links with fast-growing Asian countries. This transformation creates challenges, such as managing the pace of growth and the flow of capital to emerging markets. But it also creates opportunities to achieve a sustained rise in living standards in these countries.

Challenge for Mexico

Mexico needs to grasp this opportunity by ensuring continued stability, but above all, taking steps to make the economy more dynamic.

The important fiscal reforms put in place by the authorities will maintain an orderly fiscal situation over the next several years while preserving fiscal space for priority spending. Indeed, Mexico needs public investment in infrastructure and successful social safety net programs such as opportunidades.

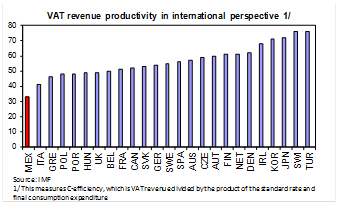

But looking further ahead, with oil revenues as a share of income forecast to decline and pressures from population ageing likely to rise, more fiscal resources will need to be found. This will require looking again at the tax system, including the structure of the VAT and income taxes, but also at the nature of spending, including on subsidies, particularly in the electricity sector.

Most importantly, Mexico needs to prioritize boosting its very low long-term growth rate and create the jobs of the future for the youth. This will require tackling some difficult issues, particularly the ones I discuss below:

- Competition. Economic dynamism is held back by a lack of competition in key sectors of the economy. Increased competition will lower costs and increase productivity, boosting growth. Recent efforts to reform the competition framework are an encouraging step forward. But experience around the world has shown that implementation—in the face of opposition from vested interests—is key.

- Public services. Mexico needs a government that can provide the services of the future, whether it is lower cost energy or better infrastructure. This will require further reforms in the public sector and to the budgetary framework. Also key here are steps to support human capital formation, including by raising education achievements.

- Labor markets. The large size of the informal economy is a symptom of the rigidities in Mexico’s formal labor market. Increasing the flexibility of the system, while considering appropriate and affordable social protections as needed, is key to create more and higher productivity jobs.

We hope to discuss these issues and challenges with leaders and young people while in Mexico with Mr. Strauss-Kahn. We want to understand better what Mexicans are thinking and planning in order to assure their rightful place in the future global economy.